The need to address the acute problem of homelessness is prompting the government to take decisions from September, which aim to release housing from Airbnb It will stimulate long-term rentals to help young couples who are currently struggling to find housing.

They are now on the table. Different scenarios and the search for the golden ratio So as not to stifle the Airbnb enterprise that provides supplementary income to thousands of citizens and revenue to the state, but also to treat those who manage a larger number of homes as entrepreneurs.

Thus, the Finance Ministry team put all scenarios on the table before the final proposal to be presented to the Prime Minister, which will also include tax incentives for those offering homes for long-term rental. Based on reports, Proposals for a direct attack on short-term property rentals, with restrictive measures on operating days and possibly with a cap on licenses per zone, are now in the drawer (to be considered in the second year), while the text that has been included in the tourism zoning bill, Which prohibits Airbnb activity near hotels!

As for the financial staff, they are moving with the logic of increasing taxes on short-term business leases and more on long-term leases.

New information about the intervention plan – under preparation – (announced by the Prime Minister) speaks about it “Two-speed” taxes. Between short-term and long-term rentals, a measure that could also be combined with tax exemptions for traditional rentals. All this, along with stricter controls and penalties for Airbnb owners who do not operate – when they should under the new legislation – as entrepreneurs.

In particular, the possibility is being considered. To reduce rental income rates Which comes from long-term property leases and increased tax rates on short-term leases, perhaps even to 22%, i.e. with a minimum business tax rate.

Today the measure applies to all incomes from Real estateTo get an income of up to 12000 euros 15%for income from 12,001 to 35,000 Euros Tax rate 35% For more income 35,001 euros, the percentage is 45%.

Many of the property owners on the top three short-term rental platforms, Airbnb, Booking and Expedia Group/VRBO, They make sure to advertise. Annual rental income less than 12,000 euros, So that the price does not “run away” from 15%. What is being considered now is to increase the minimum rate. Up to 22% for short term rentals And maintenance or a 15% reduction in the long term. The second consideration, which can be applied in combination, is the deduction of a portion of the rent received from a long-term lease from income tax.

That’s all for a start! In a second phase, more stringent proposals will be studied, which state:

One or two short-term rental properties per VAT number For natural persons. In this case, those who manage more than two properties will be treated as entrepreneurs subject to VAT and pay insurance contributions and business tax. Today, in order for a property owner to be considered a professional and start a business, he must have three or more short-term rental properties.

The rental period of each property must not exceed 90 days. For each calendar year and for islands with less than 10,000 inhabitants for 60 days in a calendar year. The period will be allowed to be exceeded if the total income of the lessor or sublessor from all properties available for rent or sublease does not exceed EUR 12,000 during the relevant tax year. Finally, the common scenario for all the above-mentioned cases foresees the combination of tax measures and the rental period of the dwellings. That is, for those who rent more days than a certain time limit, the tax rate should be increased.

Elemental crossings

Meanwhile, the Independent Public Revenue Authority (AADE) is preparing to start A barrage of checkpoints and crossings Between this year’s tax returns for short-term rental property owners and data from the major companies that run the platforms.

Sources from the Ministry of National Economy and Finance (YPETHO) and from AADE reported that the phenomenon of “black” rentals with barking on platforms continues. That is, properties that have become known through a platform (Airbnb, Booking, Expedia etc.) They are rented – usually to known clients – with secret deals, while in other cases the stay is extended informally, i.e. beyond the official data registered on the platform and the tax office.

AADE prepares to operate AI robots Who can easily see if the declared days of short-term rental companies and the declared sales volume to the tax office are the same. In other words, an algorithm will be triggered that checks income based on reservations and property availability. Audits will begin upon completion of the tax filing process. For the year 2023. What has been recorded in Forms E1 and E2 will be checked, while at the same time it will be cross-referenced with the information already sent to AADE by companies operating short-term rental platforms.

At the same time, a comparison will be made with the data declared by short-term rental platforms. In addition to comparing tax returns with the data of international groups, the movement of bank accounts of the owners of the specified properties, as well as the movement of credit cards, e-wallets, prepaid cards, etc., will be examined at the same time.

The checks will not be limited to the accounts they have in Greek banks, But data will also be requested from foreign banks, specifically from dozens of countries with which the tax authorities cooperate.

1 million beds are rented through the platform

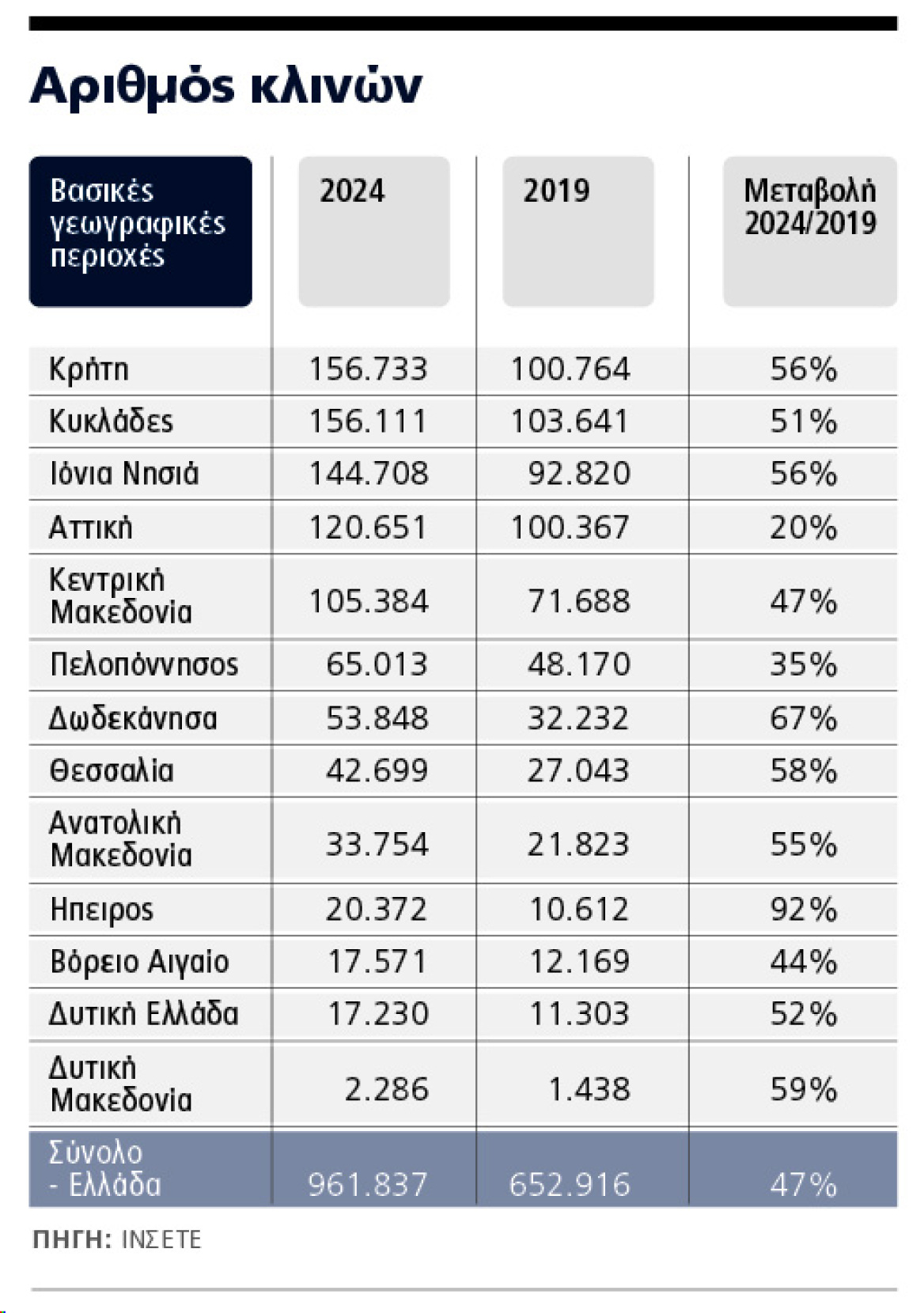

Short-term rentals up 47% in five years – nationwide bed capacity in 2019 was 653,000, up 962,000 this year

Crete, the Cyclades and the Ionian Islands have become the champions of short-term rentals in Greece. This summer, both in terms of the offer of accommodation and in terms of prices, in a season that will also be judged at the end of which the additional interventions that have now entered the discussion table for the sector and will be finalized from the autumn.

In Crete and the Cyclades this summer, the highest number of beds was recorded nationwide, with levels in fact for both destinations exceeding 156,000.

The Ionian Islands follow with numbers reaching 145,000 beds as recorded at the start of the season, early summer through to May, with numbers now rising further ahead of the warmer period of July to August.

Increase in five years

The figures, derived from data collected by the Institute of the Association of Greek Tourism Companies (INSETE) for short-term rentals, with data from the hospitality data analysis company Lighthouse (based on Airbnb, Booking, VRBO and TripAdvisor), reflect the growth of the sector over the past five years, with a total increase from 2019 to today of more than 47%: it is usual that in 2019 the number of beds nationwide reached 653,000, while the corresponding number this year is closer to 962,000.

Even higher, by 57%, is the increase in average price compared to With figures from five years ago, if we consider that the average price nationwide this year at the beginning of summer is 191 euros from 122 euros in 2019.

By destination group, one of the largest increases in supply in five years was recorded in the Dodecanese, at a rate of over 67%, with the number of beds this summer reaching 54,000, In relation to a little more than 32,000 In 2019. The main destination of Rhodes is on the move, starting this year early in the season, from the end of March, with estimates of total arrivals now being made by tourism operators. Between 3%-5% And with a tendency to extend until mid-November.

The noticeable difference this year compared to previous seasons is that Currently there is still availability for the hot August season, While an increase in demand was also recorded in the fall, which calls for an appreciation of the extension at both ends of the season.

A few days ago, the monthly study by analyst firm AirDNA (with data from short-term rental platforms Airbnb and VRBO) of the European short-term rental market recorded an 18% increase in demand for this summer between July and September compared to last year.

In the top 3 geographic areas with the largest number of beds this summer, Crete, Cyclades and Ionian, with more than 156,000 beds, as mentioned above, an increase in five years. It ranges between 51% and 56%.

The difference here is that the Cyclades offer the highest concentration of families in terms of area and population, while the two top destinations, mainly Mykonos followed by Santorini, despite the biggest offers this summer for accommodation even in August, are still showing signs of fatigue, just like last year. The average price for short-term rentals in the Cyclades at the beginning of this summer was 354 euros, the highest in the country, having risen by 52% in five years.

And even higher, as in more than 60%, It is the increase in the average price in Crete The Ionian respectively reaches 200 euros this year from 125 euros in 2019 (+60%) for the first destination and even higher, at 218 euros, from 130 euros (+68%) for the Ionian Islands. At the national level, the largest increase in prices in five years was recorded, at 79%, which also reflects the recognized tourist development in Athens, through the rental of short-term accommodation in Attica, with an average price at the beginning of summer at 136 euros.

At the household level, their number in Attica increased by 20% during the five-year period 2019-2024, Just under 121,000. On the contrary, the wider geographical area of Western Macedonia is the region with the fewest beds on offer, at around 2,300, but also the lowest average price, at €90, with a single-digit growth rate of 8% in the last five years.

today’s news:

Mourning for 22-year-old musician Sivis Giannarakis who burned to death in Chania – see photos of his burnt-out car

Germany: Every half hour a child becomes a victim of sexual assault

Chronakis and Tsanaklidou sing “Moires”

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..