In recent months, Kiyosaki has repeatedly expressed concern about the stability of the financial sector around the world, especially in the United States.

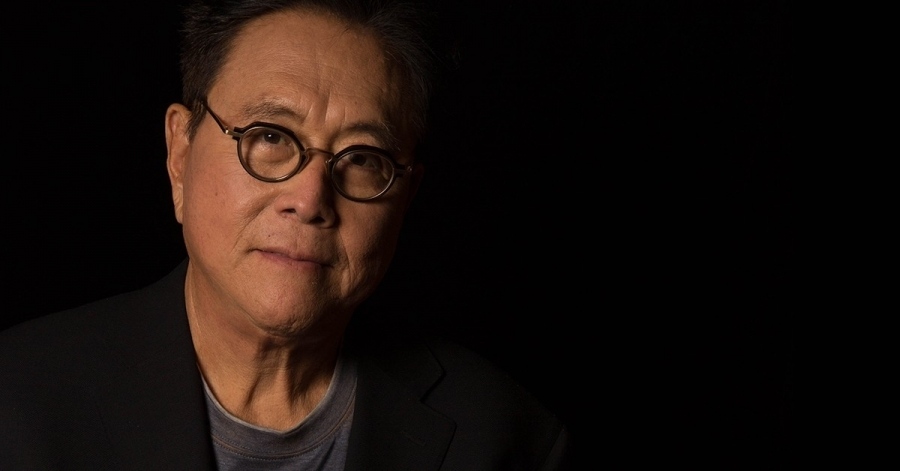

Financial book author and personal finance expert Robert Kiyosaki has caused trouble for many of his followers…

In a tweet, he “made” his fans a bold prediction of an impending global shift.

As he pointed out, without going into detail, the world is on the brink of an unprecedented paradigm shift – one that is expected to have catastrophic consequences for the global economy.

The strange thing is the following: Although the author focuses on the economic landscape, his forecasts go beyond simple monetary considerations.

As he points out, he firmly believes that those with an optimistic outlook will wake up rude, while those who adopt a realistic, or even pessimistic, stance will ultimately emerge victorious in the face of this shift.

Good news: People who follow me on Twitter know something is up. The positive PMA optimists are F’ed. The world is on the brink of the greatest change in history. The pessimists will win because they are the realists. Wake up dreamers will lose. The pessimists will win. There is a boss.

– Robert Kiyosaki (@theRealKiyosaki) June 20, 2023

Other banks will go bankrupt.

The crisis in the banking industry is far from over, Kiyosaki said, and then suggested that California-based LoanDepot Bank may be on the verge of bankruptcy.

LoanDepot reportedly lost $610.40 million last year despite cutting 6,100 jobs.

According to Kiyosaki, the crisis with LoanDepot will probably not end, as a large number of banks are still under a lot of pressure.

More banks will fail.

Rumor has it that mortgage giant Loan Depot is on the canvas.

Regional banks and mortgage companies are collapsing.

Please be careful.

I will not believe anything President Biden, Fed Chair Powell, or Treasury Secretary Yellen says.

Think for yourself.”

More banks are about to collapse. The rumor is that a giant mortgage loan warehouse is about to happen. Banks and mortgage companies in the region are in decline. Please be careful. I will not believe anything President Biden, Fed Chair Powell, or Treasury Yellen says. Think for yourself.

– Robert Kiyosaki (@theRealKiyosaki) June 15, 2023

Last week, Kiyosaki warned of an imminent collapse in real estate.

According to the author, the upcoming real estate crash is likely to be much worse than the housing market crash of 2008.

“2023 will make 2008 look like nothing.

In 2019, San Francisco office towers were hot.

In 2023, the buildings themselves will lose 70% of their value.

What will cities do with office buildings? homes for the homeless.”

“take care of yourself”

In recent months, Kiyosaki has repeatedly expressed concern about the stability of the financial sector around the world, especially in the United States.

across the Tweets He has issued warnings about possible bank failures, singling out the big mortgage companies, which he sees as particularly vulnerable.

Rather than placing blind faith in government institutions such as the Federal Reserve or the Treasury Department, Kiyosaki encourages his followers to think independently.

The author’s strategy for securing the financial future is clear: investing in tangible assets.

In June, he expressed his firm belief that the next housing crisis will surpass the scale of the 2008 recession.

To weather this storm, Kiyosaki advocates acquiring physical assets such as gold, silver, and bitcoin (BTC).

The author strongly advocates the choice of alternative assets, arguing that gold, silver, and bitcoin embody the essence of real money.

Instead, it dismisses criticism as unimportant “junk.”

www.bankingnews.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..