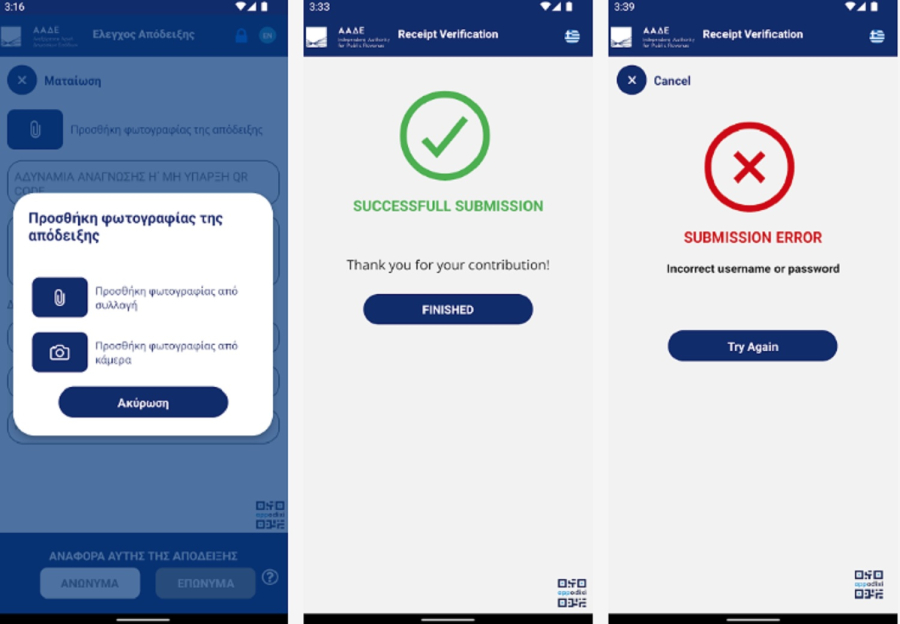

The upcoming new tax bill brings “huge” rewards to citizens who report tax evasion or “monkey” receipts. The amount is expected to reach 3,000 euros.

Up to bonus (up to) 3000 euros Citizens who join the “battle” against tax evasion through the “Appodixi” app will be able to win.

The draft new tax law is scheduled to be presented to the Council of Ministers on Tuesday, October 31.

It has been emphasized that complaints can be submitted either by name or anonymously, although even today in the application n Apodexy To date, 135,000 complaints have been filed, most of them anonymous Only 75,000 and 60,000 were named.

Self-employed professionals who systematically declare very low incomes fall under the “microscope” of the Ministry of Finance, with the provisions of the draft tax law to be presented next Tuesday to the Council of Ministers.

As sources from the Ministry of the Interior indicated to APE-MPE, the need to intervene in the tax system for the self-employed (and not in the tax rates, which do not change), stems from this year’s tax returns (for 2022 income), which are processed by AADE.

“Citizens’ Complaints” through myaade.gov.gr

Another new digital platform is available to taxpayers starting today.

This is the “Citizen Complaints” platform, available on the myAADE digital portal (myaade.gov.gr) under Apps/Popular Apps/Citizen Complaints, and it now allows interested parties to submit their complaints and information automatically, Named or anonymous, and choose one or more of the following thematic categories:

1. Corruption – integrity violations

2. Tax violations

3. Customs violations

More here.

Follow Dnews at Google News Be the first to know all the news

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..