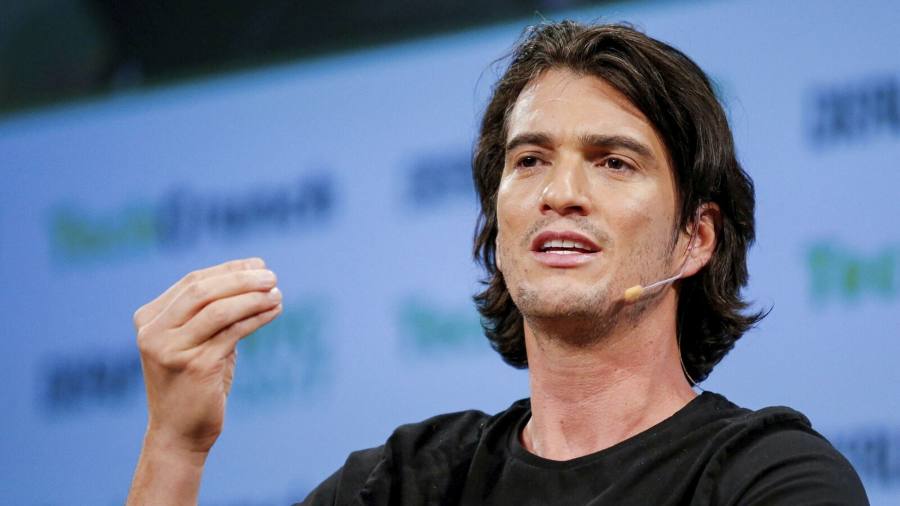

Adam Newman attracted his biggest outside investment since January 2019, when Masayoshi Son’s SoftBank placed a $47 billion valuation on WeWork, the office space company he co-founded now valued at $4 billion.

Andreessen Horowitz, a Silicon Valley venture capital firm, said Monday it has backed Flow, the residential real estate company. Newman The business has been in the works since a failed attempt to publicize WeWork prompted him to resign as CEO.

One person familiar with the matter said Andreessen Horowitz invested $350 million at a valuation of nearly $1 billion. In May, it invested an undisclosed amount in Flowcarbon, another Neumann-backed company that is trying to make carbon credit markets more transparent using blockchain technology.

in Blog postCo-founder Mark Andreessen praised Neumann as a “visionary leader who revolutionized the world’s second largest asset class – commercial real estate” and was able to make a difference in residential real estate, the single largest asset class.

“Only one person has fundamentally redesigned the office experience and led a global company to change the paradigm in the process: Adam Newman,” he said.

Referring to past controversies, Andreessen added: “We love to see repeat founders build on past successes by growing from lessons learned. For Adam, successes and lessons abound.”

Newman who left WeWork The billionaire, he revealed few details about Flow’s plans: his website only displays the words “Live Life in Flow” and “Next 2023”. A Newman spokesman declined to comment.

But in an interview With the Financial Times in March, he said he was taking advantage of the housing and affordability crises that are forcing more young Americans to rent rather than buy.

He saw at the time a “tremendous opportunity” to provide a greater sense of community in multifamily accommodations, he said at the time, and was targeting cities like Austin, Miami and Nashville, which were bringing together growing numbers of young people with job growth, cultural attractions and good skills. weather.

Andreessen, an early supporter of Facebook and Airbnb, offered few details of how Flow would operate, but said it would involve “a rethinking of the entire value chain, from the way buildings buy and own, to the way residents interact with their buildings to the way value is distributed among stakeholders.” “.

After leaving WeWork, Neumann began buying hundreds of millions of dollars in affordable rental apartments.

“We started buying this property, but then I started walking through the buildings, and I just got a sense of, and I just felt, there was a lot that could be done to improve the lives of these tenants,” he told the Financial Times in March.

Newman ventured into residential real estate with the launch of WeLive, but was able to open only two condominiums before leaving WeWork.

In 2020, his family’s office spearheaded a $42 million fundraiser for Alfred, which provides services to tenants ranging from collecting dry cleaning to booking group yoga sessions.

Alfred CEO Marcella Saboni said Flow would not use her company’s “resident experience” product. “This is Alfred’s model,” she said, “but he will focus on his buildings.” “His belief is that this will be good for both of us.”

Andreessen attracted widespread attention early on in the coronavirus pandemic, as he launched a rallying cry to Silicon Valley to invest more of his money in creating physical assets.

for him article He attacked “arrogant complacency” who he said has led to underinvestment in manufacturing and construction of all kinds, which, among other things, has led to “the frenzy of soaring home prices in places like San Francisco, making it nearly impossible for ordinary people to move in.” And take the jobs of the future.”

However, earlier this year Andreessen and his wife, philanthropist Laura Arilaja Andresen, attacked a proposal to change zoning rules in Atherton, California, the affluent Silicon Valley city where they live, to allow construction of multi-family homes, according to The Atlantic. The zoning proposal was dropped in July.

This article has been modified to correct the date the Newman family office led a fundraiser for the Alfred Company

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..