In the area of 1,420 – 1,425 points, the Athens Stock Exchange remained stuck today, falling for most of the session, while trading value was huge due to the restructuring of the FTSE Russell indices, and Optima Bank also entered the Mid Cap and Orilina zone. Micro cap entered h.

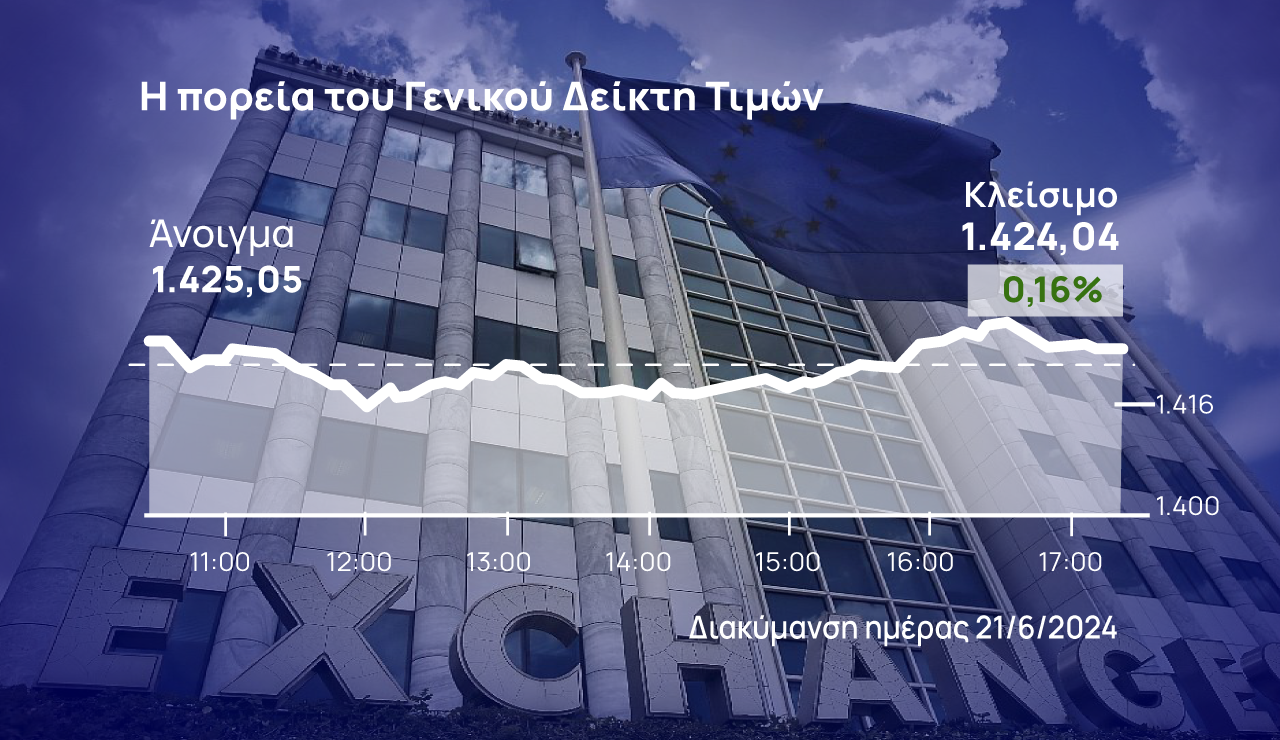

In particular, the general index closed with gains of 0.16% at 1424.04 points, while today it ranged between 1415.27 points (-0.45%) and 1427.84 points (+0.43%). The value of trades amounted to 243.1 million euros and the volume of trading was 43.8 million pieces, while 4.5 million pieces worth 18.2 million euros were traded through pre-agreed deals.

Guidelines: The semi-monthly interest is issued on Wednesday

The high capitalization index closed up by 0.15% at 3,453.22 points, while the medium capitalization index closed +0.68% at 2,272.58 points. The banking index closed with losses of 0.43% at 1,241.44 points.

The market managed to close on a positive note this week, despite yesterday’s turmoil, even after the Euro markets rebounded. The DG index rose by 1.21%, the FTSE 25 index rose by 1.22%, while the banking sector index rose by 0.04%.

Another tough week

This week, the market tried to overcome the initial “numbness” caused by the result of the European elections on European soil, but yesterday the announcement of the solidarity tax imposed by the government on refineries confirmed that the government front is not clear at home. However, the relief and optimism that came from the Terna Energy sale deal was by no means insignificant, as one cannot ignore the value of the GEK Terna agreement, but also the positive fundamentals of many of the listed companies.

But last night there was another ‘landing’ in the harsh reality of the regional market in Athens, with MSCI not only putting AXA on its watch list for a possible upgrade, but also ruling out something like that happening during the current period. year. Participants may have heard the optimistic statements of many officials about a positive development on this front, but very few people believe that the Greek market is very close to developed markets. A quick glance at the introduction to Derivatives was enough to partially assess its depth.

As for next week, now, although the market traditionally gets a better view after the expiration of derivatives (this happened today with an increase in trading volume of around 5 million euros), many portfolios may have to wait a little longer, as the landscape should clear up. in France . The first round of elections will be held in the country next week, when investors will get a better picture of the day ahead in the euro zone’s second-largest economy and its direction.

But outside this range, next week will be difficult, as the dividend cut causes significant volatility in individual stocks. On 06/25 dividends were reduced for Optima Bank (0.44), Titan Cement (0.85), Hexa (0.24), Elval Halcor (0.04), Fuhalco (0.12), Synergy (0.08), Quest Holdings (0.22), Intracom. (0.05) and Intercontinental International (4.19). The June dividend will end on 6/26 with Motor Oil 1.4, Mytilineos 1.50 and Fourlis 0.12%.

However, in this environment, the medium-term bullish picture of the market has not changed, which some who have been outside of the market will certainly see as a positioning opportunity. Especially for the liquidity that will be gradually “released” from the sale of Terna Energy and the funds that will be released after the public offer to be made by Mosadegh Hellas. For all intents and purposes, the times favor a repositioning into 25-year bonds, as valuations have corrected significantly from their peak in early May.

On the dashboard

On the board now, Titan closed up 3.20%, with Cenergy up 2.28%. Earnings were above 1% at Autohellas, Mytilineos, OTE and Ellactor, while Jumbo, Eurobank, Aegean, Lambda, GEK Terna, PPC and Coca Cola closed slightly higher.

On the other hand, EYDAP and Sarantis closed with losses of 2.99% and 2.33%, with Motor OIL, Quest, Alpha Bank and Piraeus losing more than 1%. Ethniki, OPAP, Hellenic Petroleum and ELHA shares closed slightly lower. Shares of Viohalko and Terna Energy closed unchanged.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..