Greeks use an average of 3.9 different methods to pay for their daily transactions, cash is still the first choice, and women often walk around with it in their purses.

However, more modern payment options are entering everyone’s daily practice year after year, among them electronic money transfers, prepaid cards and digital wallets, with younger ages being more open to use and older people following suit.

The shift to more modern payment methods than cash is also confirmed by the Bank of Greece data. It is noteworthy that in 2022 the number of direct debit cards increased by 5% (17.6 million pieces), while the issuance of prepaid cards increased by 20% (2.3 million pieces).

epidemic

The pandemic and efforts to reduce cash in the market to deal with tax evasion and instant payment in remote transactions, along with the development of technology, have created new methods of payment, and as it appears from research, they have already entered the daily life of the world. Greek.

The “Preferred Payment Methods of Greeks” survey conducted by Focus Bari, May 2023, shows that Greek consumers know on average of 6.8 payment methods available in the market for their transactions, but they still systematically prefer only 1.9.

Cards: How Greeks pay everyday purchases and bills

The data shows that the use of plastic money, and more specifically the use of debit cards, ranks first, with one in two Greeks choosing to use it in their transactions, while 30% are fans of plastic money – banking and mobile banking Using digital cards on a mobile phone (16%) and digital wallets (15%).

Young

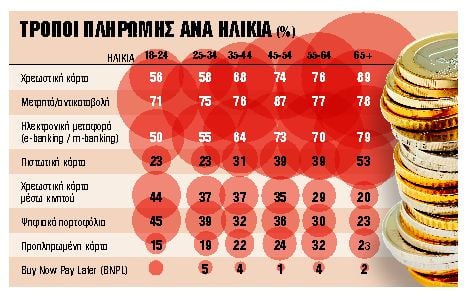

Men and younger consumers use more modern or even electronic payment methods compared to women and older age groups who still resist cash transactions. It is impressive that 81% of women continue to conduct cash transactions, while the corresponding figure for men is 74%.

Almost seven out of ten men and women use e-banking and mobile banking themselves, while surprisingly this payment method is also chosen by older consumers, 77% (55-64 years old) and 78% ( 65 years and over)) ), which does not apply to other payment methods, such as prepaid and digital cards and digital wallets, whose usage for those over 55 does not exceed 30%.

Today, out of 100 transactions made per day, 29% involve debit card, 8% credit card, 23% cash, and 3% prepaid card. In the digital payment method, 14% related to electronic transfers (electronic banking and mobile banking), 3% digital credit card on mobile phone, and 7% digital debit card on mobile phone. In modern transactional methods, 8% own digital wallets (Google Pay, Apple Pay, etc.).

supermarket and travel

In supermarkets, the use of debit cards wins at 49%, cash and cash on delivery 36%, while credit cards account for only 14% of payments, digital wallets 12%, and mobile debit cards 11%.

In bill payment, electronic transfer (electronic banking, mobile banking) is preferred at 44%, followed by debit card (27%), cash (14%), mobile digital debit (10%) and credit card ( 9%. ).

For the purchase of clothes, shoes, accessories, sporting goods and gifts or for small home purchases, the preference for a debit card is clear, with almost 1 in 2 transactions being paid in this way, while cash payments are also high (37%). ), credit card only 13%, bank transfer 11%, mobile debit card 10%, digital wallets 8%.

Finally, for travel and entertainment, the percentage of use of debit cards is 33%, cash and cash on delivery is 24%, while the percentage of electronic funds transfer is 21%, and the use of digital wallets is 7%.

source: Printed copy of Tanya

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..