The founder of Amazon decided to change his air, Jeff Bezoswhere he put $600 million in his “piggy bank” with one simple move: moving from Seattle to Miami.

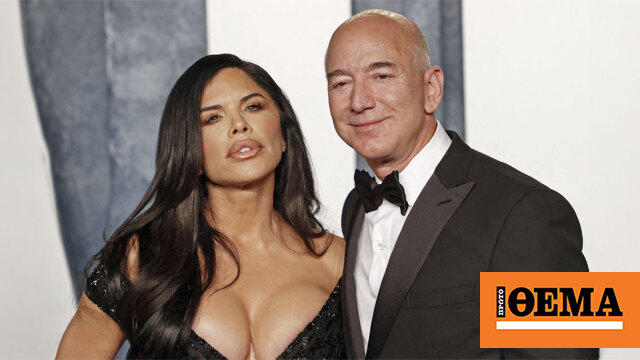

Last year, the American businessman announced on Instagram that he was leaving Seattle, where he has lived for nearly 30 years, to settle in Miami, with his beloved journalist fiancée by his side. Lauren Sanchez.

as mentioned CNBC American networkIn 2022, Washington state introduced a new 7% capital gains tax on sales of stocks or bonds worth more than $250,000. Rich Americans' plan is to “offload” 50 million of their shares Amazonbefore January 31, 2025. From the Florida sales publication, Bezos will provide At least $610 millionAmerican media comment.

Bezos' $2 billion stock sale last week came with an added bonus: It was free of state taxes.

Last year, the CEO of the space company'Blue originalHe announced on social media that he would leave Seattle, after nearly 30 years, to move to Miami, considering that he would be closer to his parents and his company, “Blue Origin.” Of course, the taxes he had to pay also played a role in the decision. Washington state has no personal income tax. Thus, the new capital gains tax will be the first time Jeff Bezos faces state taxes on his stock sales.

In 1998, Bezos began selling Amazon stock for billions of dollars. With this money, he has been able, for more than two decades, to develop a wealthy charitable project, manage his space company, Blue Origin, and recently become the owner of the multi-million dollar luxury yacht, Kuro, in addition to several luxury homes. Who he bought with his fiancée Lauren Sanchez.

In 2022, when the capital gains tax took effect, Bezos stopped selling. He has not sold any Amazon shares in 2022 or 2023, except for a $200 million stock donation at the end of last year.

After moving to Miami, Bezos made up for lost time. Last week, a document filed with the Securities and Exchange Commission revealed that one of the richest people on the planet had launched a predetermined plan to sell $50 million worth of stock before January 31, 2025. At today's price, the amount is even greater. More than $8.7 billion.

the Florida The United States has no state income tax or capital gains tax. Thus, with the $2 billion sale last week, Bezos saved $140 million that he would have paid to the state of Washington.

By selling all 50 million shares over the next year, at least $610 million will be saved. This is assuming that Amazon stock remains flat. If it continues to rise, the value of his shares, as well as his tax savings, will be severely affected.

In other words, the money he will make exceeds his expenses “Kuru” superyachtAt 127 metres, its only tax savings are in Florida.

With the money Bezos collected, he bought two mansions in Indian Creek, one of the most expensive and private places on the planet – a home for celebrities, for $147 million, while he is considering obtaining titles to other properties on the island where he and Tom Brady, the football legend, live. American and former husband of model Gisele Bündchen.

But Miami realtors say the Amazon founder will likely tear down the homes and build a new one that will cost more than $200 million.

today's news:

“I'll kill them,” Masri shouted at the company – this was the shipping company's triple-kill carbine

The story of the Carneses: the Elephina, the legal disputes, and the 2011 loss that shook the scales

Kanye West's New Video With Barely Naked Bianca Sensori – “I'll Do What I Want With My Wife”

Asimina Angelini

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..