It will be a surprise if the target of 7 billion euros in trade sales in the two months of July-August is finally “caught”, as this year’s summer discount period “burned” in the heat of July, the fire of August and the “stove” of food, fuel and holiday inflation.

Deceptive discounts: heavy “bells” in well-known cosmetics, clothing and shoe chains

An indicator of the trajectory of merchant sales is the fact that one in two merchants in Athens and Piraeus (at rates of 50.4% and 62% respectively) reported worse sales compared to 2022 during July and August. Worse still, less than 1 in 5 (18.3%) reported an increase in business volume in Athens, according to a study by the Athens Chamber of Commerce (ESA) and only 5% in Piraeus, as reported in a study by the Piraeus Chamber of Commerce. Trade (ESP) for the summer sales cycle, which took place again this year with increased participation.

Fears about the future

Equally worrisome is entrepreneurs’ low expectations for the future.

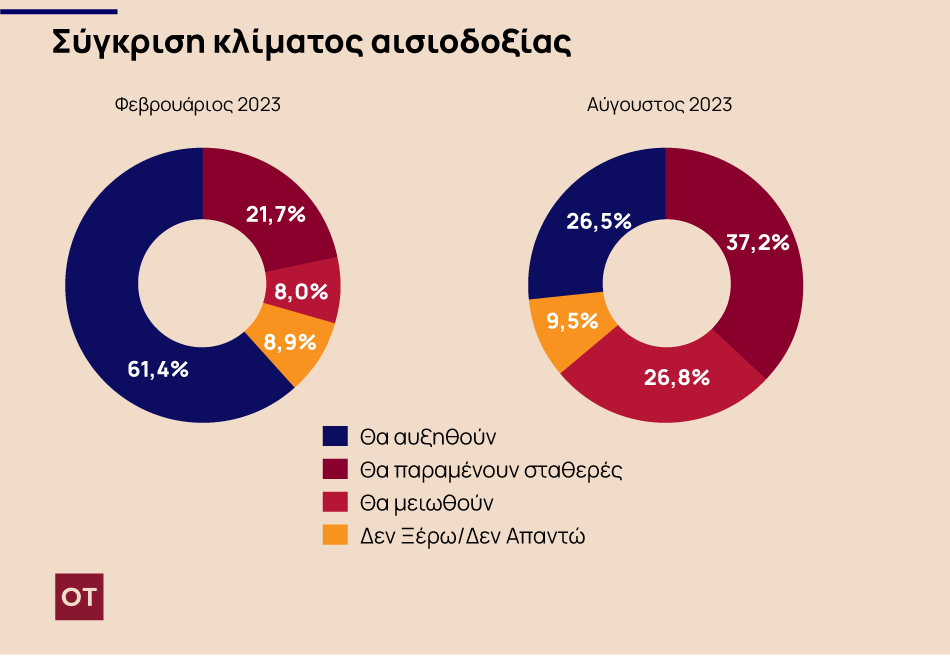

The hope for climate change and optimism for a return to growth recorded in the corresponding ESA survey at the end of February 2023, where around 60% recorded an expectation of increased sales in the next six months, has now turned into anxiety. And thinking.

The forecast is now evenly divided between the three possibilities: increase, decrease or remain at the same trading levels, without registering a dominant trend in the market.

It appears that at this particular time period, the lack of disposable household income, the increase in food prices, the current increase in fuels, as well as the ongoing global economic uncertainty, make it difficult to predict the behavior of the consuming public in the next six months. .

“Weight” of the banking system

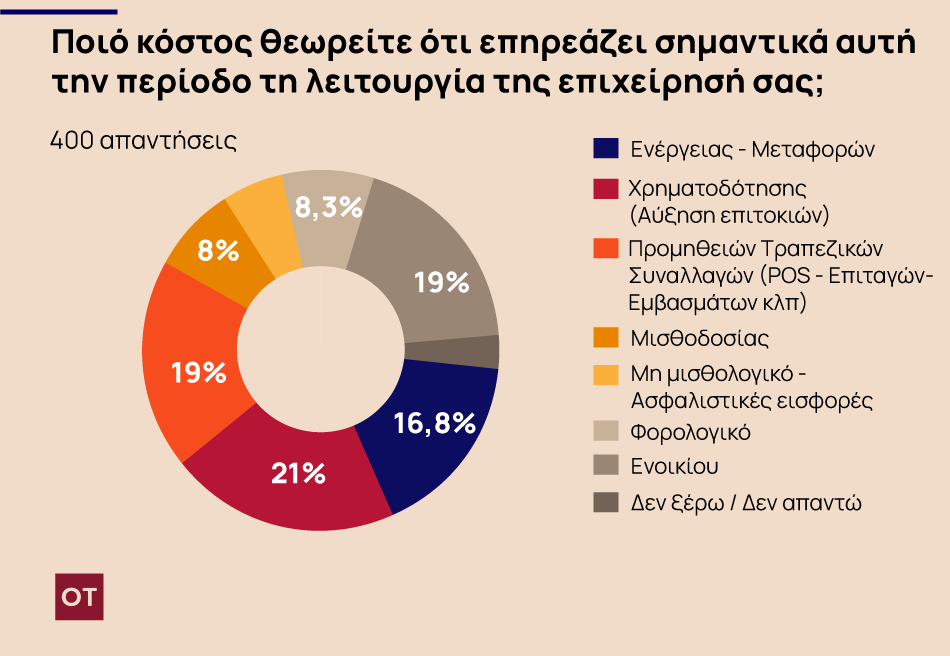

When it comes to costs that currently significantly impact the operation of businesses, the sign is clear with 4 out of 10 citing the operation of the banking system, citing high borrowing costs and rampant commission fees, across all banking transactions (points of sale, cheques, money orders, etc.). )

In second place are rent costs (19%) and energy/transportation (16.8%).

Communication with shop owners highlighted the problem of shop owners’ high demands, especially in cases of renewing lease contracts.

Finally, it is followed by taxes (8%), payroll (8.3%), and non-payroll costs/contributions (5.8%), with less impact on business operations.

The above findings show that the overall performance of the banking system must be rationalized so that it can support innovative and open business enterprises in the country

Seven out of ten merchants in Athens have an active online store

In the section on registering the digital upgrade of businesses, the survey showed that at least 7 in 10 have an active online store. The remaining 30% either do not have an online store or stated that they have created an online store, but it is not working for various reasons.

Hence, 6 out of 10 of those with digital sales cover up to 10% of their total sales.

Without tourist sales, one out of every two businesses in Athens

Another interesting finding of the research was the recording of tourism’s contribution to the coffers of businesses in Athens and the wider region.

Here it seems that tourism in half of the points of sale does not contribute to their turnover either because they do not operate in a tourist area or because the product (such as furniture, mattresses, etc.) does not meet the needs of foreign consumers.

More than 1 out of 3 stores owe up to 25% of their money to tourists and the rest who declare more than 50% or even all of their sales to tourism, are active in purely touristic markets such as Plaka and others.

However, analysis of research data showed that in the tourist area, despite the large number of tourists, the sales volume not only does not rise proportionally, but also shows an average decline.

It should be noted that in the ESA survey, which was conducted within the framework of a cooperation agreement with the Athens University of Economics, the majority of stores in the sample (6 out of 10) belong to the clothing-shoes-accessory category. Which plays an essential role in the discount period.

66.5% of the points of sale in the sample operate within the boundaries of the municipality of Athens, while for the first time the shops in the tourist area of Athens were registered separately.

Piraeus traders are able to adapt

At the same time, ESP research concluded that the main problems faced by the market today are the decline in consumer spending by customers, the tightness of the series of basic goods that put pressure on household income and the different priorities of their needs.

On the other hand, the Piraeus market sent a positive message, as the survey showed its high ability to adapt to new challenges. One in two companies reported that they have absorbed all price increases and offered aggressive discounts, while the percentage of stores that are getting a digital channel and investing in their overall upgrade is increasing.

It is particularly important to note that the extensive controls implemented in the market during the discount period showed zero degree of delinquency of trading enterprises. They have proven time and time again their high level of compliance with the law, their financial awareness, and their special attention to their most valuable asset: their relationship with their clients.

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..