Unlike other monetary policy makers, ECB officials face the additional challenge of setting one policy To many different countriesEach has its own fiscal policy, economic outlook and debt level.

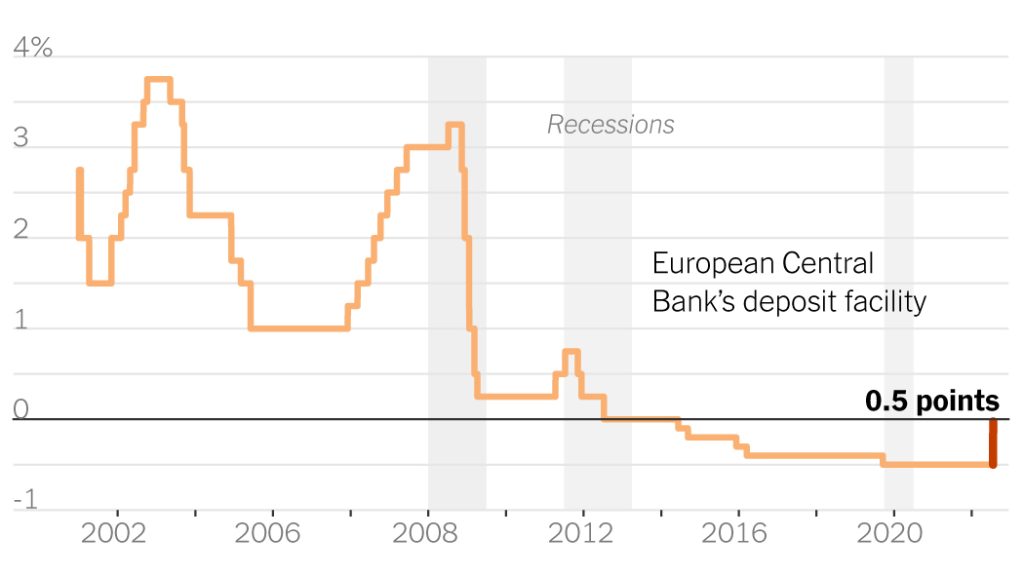

While the bank is tightening its accommodative fiscal policies by raising interest rates and ending bond-buying programs worth billions of euros, it is also trying to prevent government borrowing costs from diverging significantly across the eurozone and hampering the effectiveness of monetary policy.

The bank is expected to announce more details on Thursday A new policy tool you’re designing to stop borrowing costs from rising asynchronously With the economic fundamentals of the country.

These differences between countries are most clearly reflected in sovereign bond yields, a measure of government borrowing costs. Investors will demand higher returns from countries they think are riskier than lending, possibly due to a history of debt defaults, political instability or slow economic growth.

Borrowing costs for Italy, which has one of the highest rates Eurozone debt burdens have risen sharply since the European Central Bank reaffirmed its plans to raise interest rates. This week, it rose again when The country’s government has collapsed, with Prime Minister Mario Draghi resigning on Thursday after being abandoned by key parts of the government coalition. The difference, or spread, between Italy’s and Germany’s 10-year sovereign bond yields is now double what it was at this time last year.

The European Central Bank considers a sudden break in the relationship between government borrowing costs and economic fundamentals The so-called market segmentation. She said she would not tolerate this as it would reduce the effectiveness of other monetary policy tools to reduce inflation.

“It is critical that financing terms are broadly synchronized across the eurozone when we change our stance,” Luis de Guindos, the bank’s vice president, said earlier this month. “For two equal companies in the eurozone, a change in the monetary policy stance should lead to a similar reaction in their financing conditions, regardless of which country they reside in.”

At the end of June, the bank announced that, from the beginning of July, it would apply its first line of defense against retail by directing reinvestments of proceeds from maturing bonds in its 1.85 trillion euro ($1.88 trillion) pandemic-era bond purchase program. To the linkages of countries that would better support their monetary policy objective of consistency. For example, you might use the yield on German bonds to buy Italian debt.

At the same time, the bank said it is working on a new tool to stop borrowing costs varying widely in some countries. Internal disagreements over the design of this instrument had to be overcome to ensure that it did not encourage governments to be fiscally irresponsible on the basis of the belief that the central bank would be bailed out.

The central bank has been through this battle before. At the height of the eurozone sovereign debt crisis a decade ago, the central bank attempted to design a policy tool that would match the commitment of Mr. Draghi, the then European Central Bank president, to do “whatever it takes” to save. euro. It was met with many political and legal challenges.

In the end, the tool, which would allow the bank to make unlimited purchases of state debt if the state was part of the official rescue and reform program, was not used.

The new tool is expected to come with fewer conditions for the country to take advantage of.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..