There’s been a lot of talk lately about this topic where are you going for the economy due to the fact that United States of America Many of them are going through difficult times.

Many wonder whether American hegemony is coming to an end, whether the dollar will cease to exist as the world’s reserve currency, and whether the solution is gold or Bitcoin.

According to Gold Switzerland, the US is declining, but it won’t end that way.

The dollar remains the primary currency for spending, liquidity and foreign exchange.

But it is no longer the highest saving asset.

Gold (now a Tier 1 asset…) It would still be a better reserve of value (i.e. it holds its wealth) than any amount of money – and Bitcoin is sure to make headlines in the future.

In any case, the dollar, as well as US bonds, says the Swiss House, are now quantitatively less valuable, less reliable, less strong and healthier… – much less than they were at Bretton Woods around 1944.

In 2022

When policymakers used what should have been a neutral global reserve currency as a weapon against a major nuclear power (by stealing $400 billion worth of Russian assets), the BRICS alliance was already taking shape.

In short, many countries in the world, including petro-states, have realized that they need reserve assets that cannot be frozen or stolen at will, and at the same time retain (rather than lose) their value.

But instead of the dollar ending up as the world’s reserve currency, most of that world revolves around or outside of it…).

data…

Hard data is available: dozens of countries BRICS+ group They trade outside the dollar, trade local currencies for local goods, and then offset the surpluses with actual gold, which is priced better/fairer in Shanghai than in London or New York.

This means that decades of precious metal price manipulation on legal scam platforms like the COMEX have come to an end after Basel III and after the sanctions.

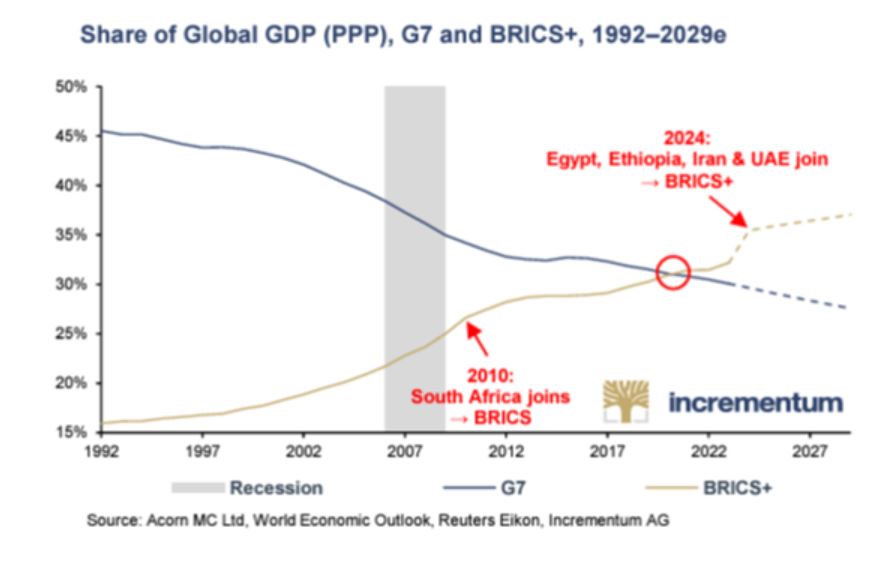

This matters because, like it or not, the rising power of BRICS+, which has grown tired of being dogged by the increasingly inflation-extracting tail of the dollar, is now growing in terms of economic power – away from the indebted West.

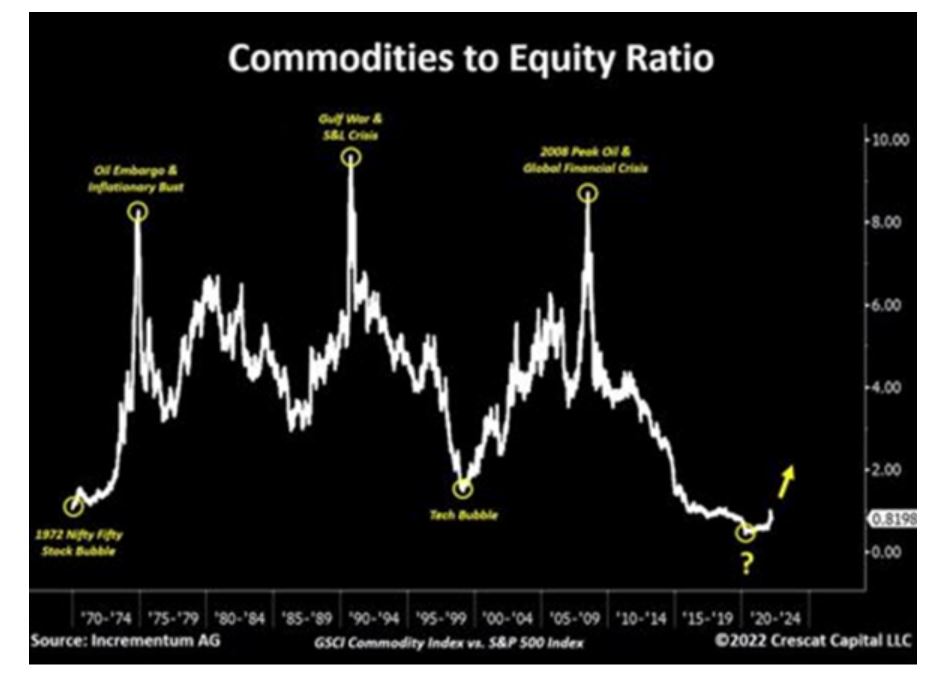

An analyst posted a similarly critical chart a year ago, asking, somewhat rhetorically, if this isn’t the chart of the decade?

That is, he wondered whether the world was moving toward a commodity supercycle, where real assets begin to show a slow rise against falling stock markets and an increasingly depreciating dollar.

As Grant Williams says, that’s what smart investors should do.

Change with petrodollar

When it comes to commodities, currencies and therefore gold, everything is changing around us – at least for those with eyes to see and ears to hear.

To this end, we cannot ignore what is happening in global energy markets, says Gold Switzerland and adds:

“Oil, like any other element of international supply and demand (i.e. trade), can be settled equally in gold and not in petrodollars pegged to the dollar.

(In 2023, by the way, 20% of global oil sales are outside the dollar, a fact that would have been unimaginable before the White House imposed sanctions on Russia.)

The implications of this simple observation for (as well as its impact on) the dollar, commodity prices, and gold are extraordinary.

The recent past

Before the United States used the dollar as a weapon against Russia, the world was “pulling” the line between the dollar and trading oil for dollars, which was very convenient for Uncle Sam and the American modus operandi of exporting inflation for everyone else.

For example, in the past, when commodity prices were very high, countries like Saudi Arabia would eat up US Treasuries and cause the dollar to rise a lot.

This, of course, was useful for stabilizing and absorbing the weak and overproduced dollar.

At the same time, this helped US Treasuries remain high thus compressing yields.

In some ways, this has been beneficial for global growth, as the dollar has remained stable and low enough for countries like China and other emerging markets to develop.

These other countries, in turn, continued to purchase “risk-free” dollars, thus helping to reverse the “rehabilitation” of the US debt-based growth narrative.

“After all, if anyone else bought his bonds, Uncle Sam would be able to finance the American dream with debt all the time, right?” Switzerland gold reports.

This case ends with Kingdom of Saudi Arabia To get closer than ever to the BRICS group, which is looking for a way to outpace the dollar and US Treasuries in trading with each other – including oil…

This means that the system that has worked in favor of the dollar and the government bond market since the early 1970s (i.e. global demand for the US dollar via oil) is slowly (but surely) ending before Biden’s barely open eyes…

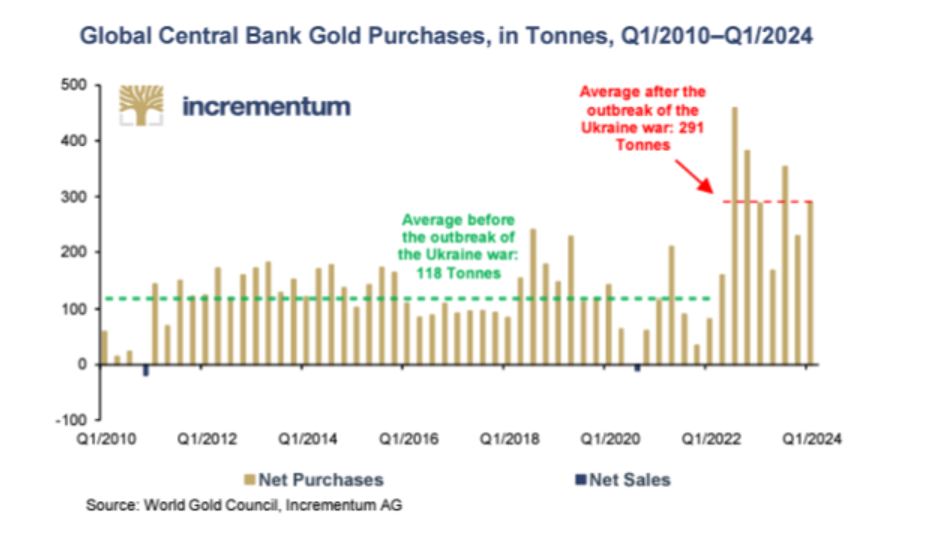

Somehow, all commodities from copper to oil will be bought outside the dollar and settled in gold, which likely explains why central banks have been hoarding pure gold (top line) and dumping pure dollars since 2014…

www.bankingnews.gr

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..