the biggest Excess deposits Of all the banks in the eurozone, it was the Greek banks that did this, which also explains their reluctance to offer better returns to depositors. But in 2024, banks aim to use this surplus to aggressively increase lending, as the profits they make from the spread between lending and deposit rates will peak in the first quarter of the year, while also rising immediately after the ECB's interest rate cuts. is expected to start.

Its details Single Supervisory Mechanism of the European Central Bank The results of the third quarter of 2023 confirm more than ever the paradoxical situation created in Greek banks by the fact that they were involved in a disastrous multi-year economic crisis for them, where, among other things, they found themselves with half their funds. Their loan portfolios are “in the red”.

And so, instead Deposit flows In an environment of economic growth and stability, loan portfolios returned to normal, at the same time Elimination of Forests, Mainly through the process of securitization with state guarantees (“Hercules Plan”), new grants are provided with a dropper and are not sufficient to restore the balance between loans and deposits.

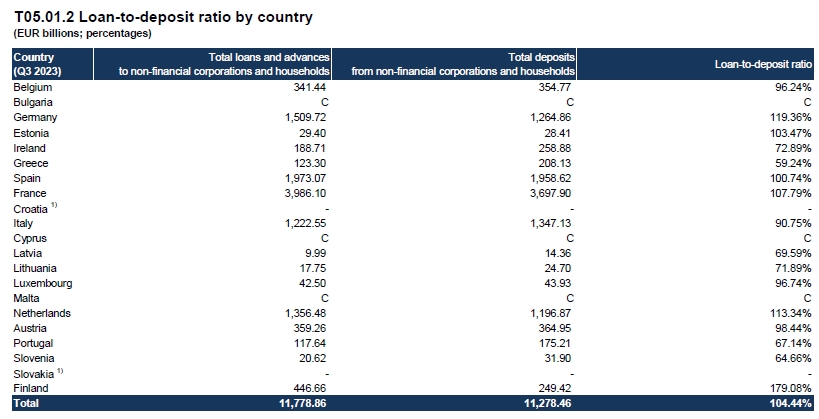

The SSM figures (see table) paint a picture of a banking system that is awash in deposits without using them to make loans:

- Deposits at the end of the third quarter exceeded 206 billion euros, compared to loans amounting to only 123.3 billion euros.

- So the relationship Loans to deposits It was formed by less than 60% (59.24%), at a time when the euro area average 104%, Banks grant loans that exceed the size of their deposits, using financing from other sources as well. In theory, if Greek banks set their loan-to-deposit ratio at 100%, they would have to grant additional loans worth up to 83 billion euros! The amount, of course, would be enough to make the economy… turbo.

- Greek banks do it Championship…a decline in the ratio of loans and deposits in the euro area, No national banking system has such a low ratio. Only Slovenian banks, at 64.66%, have a ratio somewhat close to that of Greek banks. There are also national banking systems with surplus ratios, such as the Finnish system which is close to 180%. The indicators in the two largest economies, Germany and France, are well above 100%.

The relationship between loans and deposits in eurozone countries (Source: SSM)

“Gas” in granting the new loan

the distortion Because of excess liquidity and “lean” lending, bank managements also know that they cannot be extended, especially from 2024 onwards, as they will not get the same strong boost to their profits from interest rate spreads and will need to increase buffers as quickly as possible. their loan portfolios, This is to replace the “red” loans that have left the balance sheets with new, healthy loans.

the Credit expansion accelerated It will be in 2024 The ultimate goal of bank departmentsas initial expectations of a significant acceleration in credit growth in 2023 were refuted.

Bank staff are said to be making plans to significantly accelerate lending, especially from the spring onwards, when the ECB is expected to send the market… The first “sign” of policy easingS, a decrease of 0.25%. There are two areas where banks will “gas” to regain lost ground in 2023:

- Regarding business loans, Which is also the engine of credit expansion. Banks enter the new year with a new and very powerful “weapon”: additional cheap loans of 5 billion euros from the recovery fund, which were recently approved for Greece and allow new money to flow. Used for low-interest loans, the 13 billion of cheap loans originally approved have almost been exhausted. By introducing a mix of business loans, these low-interest loans will allow financing to be provided to companies on good terms for investment and working capital, in order to overcome the problem created by the high level of bank interest rates in the demand for loans.

- Sta mortgage loans, In 2024, banks are expected to make the first fundamental attempt to reheat this category, which has moved from the stage of huge excesses before the financial crisis, to the stage of absolute drought in recent years. One of the key elements of the new generation of housing will be an increase in the value of properties to be financed with loans and a general relaxation of lending conditions.

As far as they are concerned deposits, However, it is clear that the huge surplus of deposits will push banks to extend the ECB's lifting pass policy very slowly. So far, banks, according to the Bank of Greece, have passed on a third of the ECB's increases to depositors, and everything seems to indicate that they will not have time to pass them on in full before then. The European Central Bank begins cutting interest rates again. Especially on single-day deposits, which also represent the main volume of deposits, returns will remain close to zero.

Source: sofokleousin.gr

Follow the Metrosport.gr page and Google News

Join our group on Instagram

Like our page on Facebook

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..