![Inflation: Türkiye’s Biggest Bet to Win at Any Cost [γραφήματα] – Financial Postman Inflation: Türkiye’s Biggest Bet to Win at Any Cost [γραφήματα] – Financial Postman](https://www.ot.gr/wp-content/uploads/2024/03/TurkeyElexFlags.jpg)

Turkey has already taken a significant step in trying to get out of the economic crisis, after years of unconventional policies. The numbers are gradually starting to flourish, and the big bet now for President Tayyip Erdogan’s government is that the citizens will start to flourish too.

Rating agencies, international investors and banks are beginning to give Ankara confidence, especially in its efforts to deal with the very high prices, as reflected in recent developments:

- Moody’s upgraded the country’s credit rating by two notches to “B1” from “B3” while maintaining a positive outlook. The rating agency estimates that the country has recorded improvements in governance, and spoke of “an increasingly decisive and unified return to conventional monetary policies, which is yielding the first clear results in terms of reducing the country’s large macroeconomic imbalances,” the related announcement said.

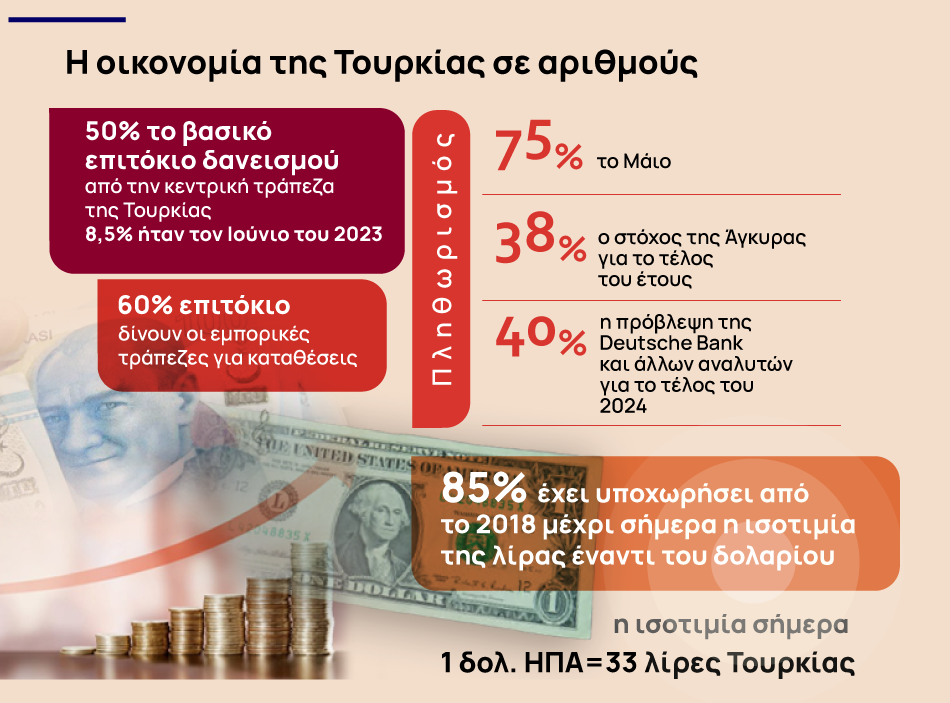

- Fund managers have pumped around $24 billion into the Turkish lira since October in a bid to take advantage of the country’s high interest rates, which are currently above 50 percent as the country’s central bank tries to tackle inflation, according to Financial Times data. The move carries risks that the trend could reverse if the situation worsens, but for now foreign money is starting to make its presence felt in the country again.

- Deutsche Bank, Germany’s largest lender, expects inflation in Turkey to fall significantly in the coming months, bringing the economy back into balance without a sharp downturn. Speaking to Anadolu Agency, Hans-Christian Vitoska, Deutsche Bank’s head of research for Central and Eastern Europe, the Middle East and Africa, estimated that Turkey has completed the first phase of rebalancing its economy and is now entering the second phase.

Moody’s: Turkish economy improves after 10 years

“We expect inflation to reach around 40% by the end of the year due to the slowdown in domestic demand… and the recent stability of the pound. We expect a strong process of reducing inflation,” according to the estimates of the CEO of the German bank.

“The main question, but also part of the second phase, is for inflation to reach 20%. That’s the next step, and that’s a challenge because it will be around 40% by the end of the year,” he added, saying it would be crucial for the central bank to maintain a tight monetary stance.

Lower prices on products, services and real estate in Türkiye

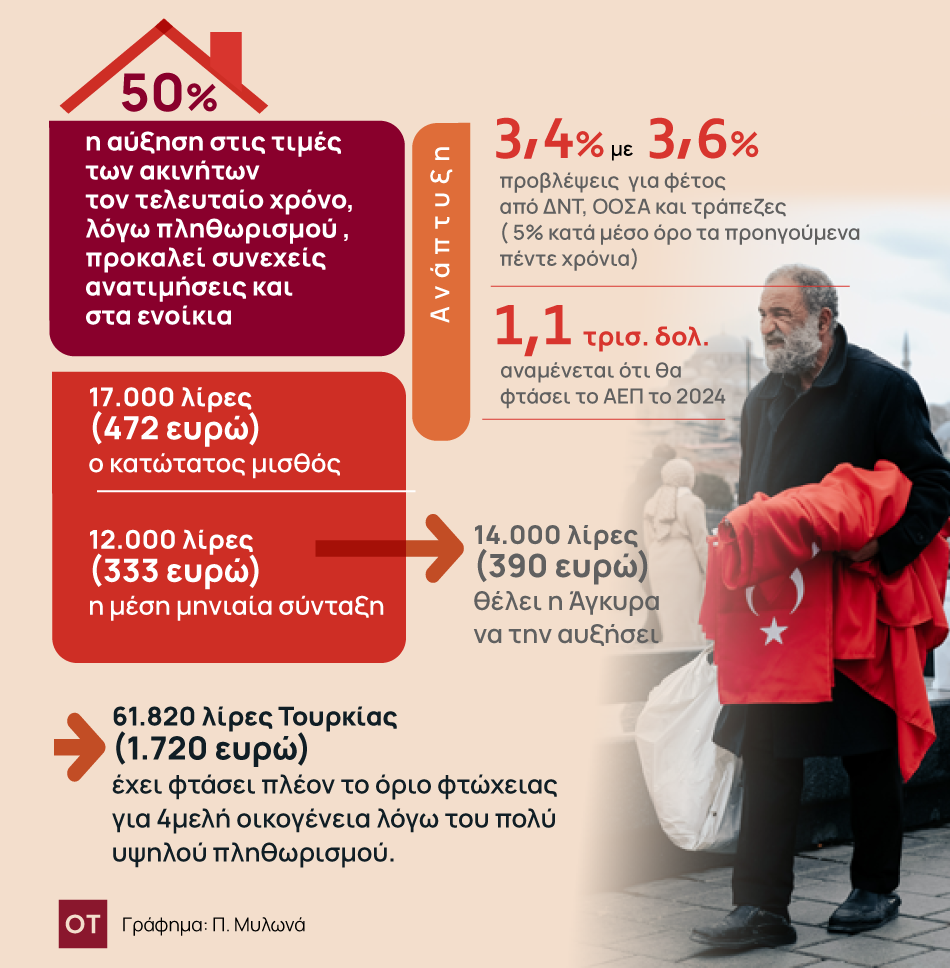

Economists at Deutsche Bank expect Turkey’s GDP to grow by 3.5 percent this year, from an average growth rate of around 5 percent over the past five years.

After the 2020 elections, Turkey made a major shift towards more conventional economic policies to bring down inflation, which reached 75.45% in May from 69.8% in April. Inflation reached 71.60% in June. All this, as expected, led to massive increases in goods, services and real estate, pushing many into poverty and widening the income gap between the haves and have-nots.

Mehmet Simsek, Turkey’s finance minister and Erdogan’s economic chief of staff and right-hand man, has forecast inflation in May to be the highest level before his ouster, and is now working with the Turkish central bank to forecast the year-end inflation rate at 38%.

International Economic Outlook

The International Monetary Fund expects Turkey’s economy to grow by 3.6%, while the OECD expects growth of 3.4% in 2024.

While inflation and domestic demand have begun to moderate, inflationary pressures are expected to ease significantly in the coming months and into 2025, Moody’s also believes. The board notes that the Central Bank of Turkey (CBRT) is working quickly to strengthen monetary policy credibility, which in turn is helping to restore confidence in the Turkish lira.

Big bet on citizens

These figures show an improvement in the growing economy, with GDP expected to reach $1.1 trillion in 2024, and the big bet now is to improve the daily lives of citizens who have made great sacrifices in recent years.

Many Turks have commented on their declining living standards, but they also feel ashamed of their declining living standards, paying the price for President Recep Tayyip Erdogan’s past economic mistakes, even as there are signs that the country is beginning to emerge from a cost-of-living crisis. Reuters has a comprehensive report on the situation in the country a few days ago.

Reuters data shows that six years of high inflation, coupled with a huge credit squeeze last year, have pushed pensioners and wage earners closer to poverty, “testing Turkey’s social fabric more than at any other time during Erdogan’s rule here and more than at any other time in his two decades,” she says.

Young Turks say they are now giving money to retired parents and grandparents, breaking with Turkish tradition. This comes as workers struggle to pay monthly bills and forgo small daily luxuries like eating out.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..