platform for Maternity allowance for self-employed mothersThis makes this benefit accessible to self-employed workers, self-employed women and farmers.

Maternity allowance continues 9 months and equals the minimum wagewhich is currently 830 eurosand its total is 7470 euros.

In combination with the maternity allowance, the total amount can reach up to €10,970, or €1,200 per month.

In fact, the mother can transfer the maternity allowance to the child's father. It is emphasized that like all OAED entitlements, maternity allowance is paid on the last working day of the month, with the funds appearing in the accounts the day before.

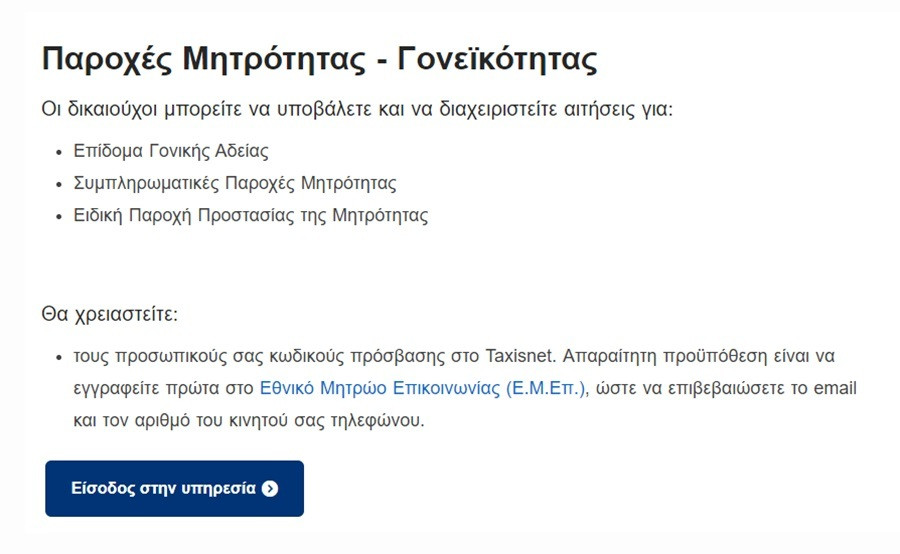

To apply, you must log in to the platform parentalbenefits.dypa.gov.gr (here) It has taxi codes.

Maternity benefits: 11+1 questions and answers

The guide issued by the Ministry of Labor is detailed.

1. Who is entitled to special maternity benefit?

As of today, self-employed women and farmers receive a special maternity protection benefit. The special allowance is granted for 9 months and is equivalent to the minimum wage, which currently stands at €830. That is, they will receive a total of 7,470 euros. In fact, if we include the maternity allowance, which is €2,400 for the first child and up to €3,500 for the fourth child, a self-employed mother gets up to €10,970 for 9 months. Thus, the monthly income starts from 1,100 euros and reaches 1,200 euros depending on the amount of the maternity allowance.

2. What is the situation for self-employed women so far?

So far self-employed people receive a one-off post-partum pregnancy/maternity allowance as follows: OAEE self-employed people receive €600, farmers €486, and engineers, lawyers and health professionals (ETAA) €800. euro.

3. What applies to working mothers

Working mothers accordingly enjoy a special maternity allowance. In fact, less than two years ago, in November 2022, the benefit payment period was extended from the 6 months that applied at the time to 9 months. The result is the additional benefit of increasing the repayment period

Providing and increasing the minimum wage from €713 in November 2022 to €830 today, reaching €3,200. The benefit increases with the maternity allowance, which starts from 2,400 euros for the first child and reaches 3,500 euros for the fourth child.

4. I am self-employed, what do I need to do to receive special maternity protection benefits?

In order for a self-employed worker, i.e. a self-employed woman, self-employed worker or farmer, to be able to receive a special maternity protection benefit, she must follow the following steps:

- First: You must have obtained the electronic maternity allowance (pregnancy and childbirth) from eEFKA, and you must apply for the special maternity allowance within two months from the day following its disbursement.

- Second: An application for granting a special maternity protection benefit shall be submitted to the following address: parentalbenefits.dypa.gov.gr (here).

- Third: In cases where the applicant is not registered in the digital registry of D.YP.A, it is necessary to register on the new platform through a special form available for this purpose. The private form is accessed using icons Taxis and AMKA.

- Fourth: He must be informed of the insurance when submitting the application and upon receiving the benefit.

- Fifth: Especially for mothers who have given birth to a child through the adoption process, an application must be submitted to D.YPA.A. It is submitted within two months from the day after the child is integrated into the family or the court decision is final.

5. When does the special maternity allowance begin to be paid to self-employed workers?

Payment of the Special Maternity Protection Benefit begins on the first day of the month following the submission of the application. It should be noted that the provision for maternity protection is tax-free, non-assignable or seizable in the hands of the State in the broad sense or to third parties, and is not subject to any fees, charges or other withholding in favor of the State or e-EFKA.

6. What applies if I do not update my insurance?

If the beneficiary does not have up-to-date insurance when submitting the application, a notice “The application cannot be submitted due to lack of up-to-date insurance” appears, so that she can pay her debts immediately. With the payment, the EFKA system and thus DYPA are instantly updated through the interoperability of the systems, so the insured returns to the platform and will submit the application normally.

If the insured woman pays the insurance contributions due, she can apply to re-issue the benefit electronically

Retroactive to the month in which it was interrupted. However, in all cases, the total duration of payment of the special maternity protection benefit, after deferment of payment of insurance contributions, cannot exceed 12 months.

7. If you hold down a job at the same time, what applies?

The mother, who simultaneously maintains a working job, receives the benefit as a working woman. If during the leave she loses her status as a tenant, she may during the remaining period of time obtain the special benefit, i.e. as a non-tenant, if she submits a relevant application to the D.YP.A.

8. What other subcategories of self-employed women receive special maternity allowance?

The right to the maternity protection provision for self-employed persons extends to the intended mother, who obtains a child through surrogacy, to the self-employed person, who adopts a child from the time the child joins the family until the age of 8 years, and to persons of the same sex after Declaration of the beneficiary of the special benefit through a joint declaration from the spouses to e-EFKA.

9. Can I transfer the special maternity grant?

Yes. The mother has the right to transfer up to 7 months of the special maternity protection benefit to the father, regardless of whether he works under a special law, is self-employed or a farmer, as long as he is insured.

A necessary condition for the transfer to be valid is that the child's mother must have previously received the special allowance for at least the first two months. The same applies to same-sex couples after declaring the beneficiary of the special subsidy through a joint declaration of the spouses to e-EFKA.

10. Why was the right of retrospective effect only granted to mothers who gave birth to a child from 24 September 2023 onwards?

According to the Ministry, the retroactive effect was granted for a period of 14 weeks to include all mothers who had previously given birth and were undergoing a cesarean section when the law was issued. As noted, the 14-week period is not arbitrary, but was determined in accordance with European Directive 2010/41.

This is the period specified by the European legislator as the minimum that allows a self-employed woman to temporarily interrupt her profession due to pregnancy or maternity, given that she cannot obtain specific leave due to the nature of the profession. She is self-employed without an employer and is therefore not eligible for a license in the strict sense.

11. Who pays the benefit?

Special maternity protection benefits for self-employed workers are funded from DYPA's former Special Unemployment Account for Self-Employed and Self-Employed Personnel, to which the maternity benefit grant is supplemented and now renamed the Special Account for Self-Employed Persons and Self-Employed Persons. The provision for maternity protection for female farmers is financed from the state budget.

12. When does the support stop?

The benefit is cut off if the insured loses her professional status during the special benefit period or is not notified of the insurance or submits a request in this regard.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..