As an opportunity for more funds to flow into the Greek stock market and to grow the investment base, the management of the Athens Stock Exchange sees the start of trading from today, Wednesday, May 10, for the new MSCI Greece Rebased Index.

This was confirmed at yesterday’s event at the Hellenic Stock Exchange headquarters in the presence of CEOs and CEOs of banks, as well as in the presence of MCSI (through life and hybrid).

Athens Stock Exchange: Start of trading the new derivative on the MSCI Greece index

In essence, this is an informal “reboot” of the derivatives market on the Greek market, the first attempt of which in 2015 did not yield the expected results. At first there was interest, but it gradually faded and sales followed a diminishing trajectory.

But the past is the past and now the Athens Stock Exchange – after a year of preparation as we indicated yesterday – is moving to a new phase (with the ultimate goal of “promoting” and returning the Greek market to a category that has been developing since the advent of the present), now having at its disposal not only MSCI Standard Greece, but also the re-established MSCI Greece “twin”.

“Twin” because it consists of 10 stocks that make up MSCI Standard Greece, ie: OTE, OPAP, Eurobank, Alpha Bank, Jumbo, National Bank, Motor Oil, Mytilineos, PPC and Terna Energy.

the moment

As the CEO of a brokerage told OT on the sidelines of yesterday’s event, the timing of the new market launch seems perfect. The Greek stock market is finding a foothold, trading volumes have increased compared to the previous year, and above all, the expected modernization of the Greek economy by rating agencies will mean that foreign investors will return and Greek securities will be able to be included in their accounts. Portfolios (in those where there is a restriction on placement only in investment grade securities).

In response to a question about the current moment (in light of the upcoming elections) by journalists at the end of yesterday’s event, the Chief Operating Officer (COO) of Hellenic Stock Exchanges SA, Nikos Porphyris, replied that it was good that the new index until two weeks before the elections entered the markets, then when The formation of the new government will have been tested and given the first samples of writing.

In this case, if there is no unpleasant development, the new index will be traded unaffected by political developments in Greece.

More options

The advantage that the re-established MSCI Greece index has over the already existing derivatives market is more choice in the contracts on offer.

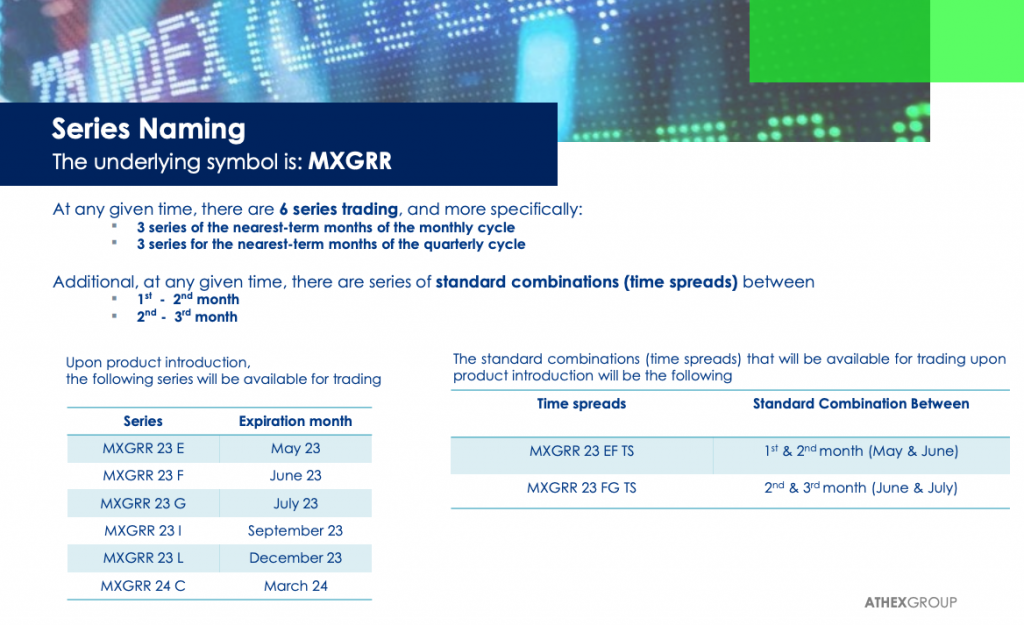

Investors will now be able to place themselves in contracts with a duration of more than a month, and specifically starting from today’s date, the available options are 6:

- May 2023

- June 2023

- July 2023

- September 2023

- December 2023

- March 2024

Specifically, the contracts offered are broken down as follows:

- 3 rows of the nearest month of the menstrual cycle f

- 3 series to the nearest months of the quarterly cycle

These options provide novelty to the new index, as investors can now “roll over” their positions and this rollover means that funds or part of them can remain in the market and not flow out of closing positions.

New product features

- The new products offered will have the following characteristics:

- Contract Type: Standardized Futures Contracts (SFCs) that are settled by cash-only transactions

- Headline: The Re-established MSCI Greece Index

- Contract size: 2 EUR (multiplier)

- Face value: around 9,000 euros/contract

- Series: 6 series in circulation at any one time

- End time: 17:20

- Daily Volatility Limits: The maximum daily price fluctuation is set at +35% or -35% on the starting price (reference price)

investment base

Currently, the current derivatives market contains 40 products. On the ATHEX derivatives market, the first floor is occupied – as mentioned in yesterday’s event – by 7 market makers, whose trading activity accounts for 42% of the total.

Investors are now given greater flexibility to position themselves in the new products of shares traded in the MSCI Standard Greece Index.

As Emmanuel Skaramis, Head of Market Operations and Supervision, pointed out yesterday during the presentation of the MSCI Re-established Greece Index, new products should cover the existing “appetite” on the part of investors for such products.

Thus the investment base is broadened, with options for more products. The re-established MSCI Greece Index is based on MSCI’s Global Investment Market Indicators (GIMI) methodology and is designed to measure the performance of the large and medium sectors of the Athens Stock Exchange, which covers approximately 85% of its total capital.

The CEO of the Athens Stock Exchange Group, Yanos Kontopoulos, said: “We are pleased to introduce today the new derivative product on the re-established MSCI Greece Index. This is an important step in our continuous efforts to expand and enrich the range of products traded on the local stock market. We are confident that this new product It will be an important addition that will enhance the liquidity and efficiency of our derivatives market, and in cooperation with stakeholders we will do our best to ensure its success.”

George Harrington, Global Head of Derivatives at MSCI commented: “MSCI is particularly pleased to be working closely with the Athens Stock Exchange to create this new product. The development of this ecosystem is particularly important for all users of MSCI Indexes.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..