The United States is constantly accelerating its daily oil production, breaking all records, and as a result is constantly demanding larger and larger export quotas, threatening other major powers in the space, such as the head of OPEC+, Saudi Arabia.

It's basically a clash of titans with Black Gold being the best-selling prize worldwide. For now, this competition is probably beneficial to consumers, as prices have stabilized in recent months after falling, despite the fact that there are two major wars going on not only in Ukraine but also in the Gaza Strip – with all the accompanying problems. In the movement of energy and goods (and) in the Red Sea.

Russia: High crude processing levels continue in mid-December

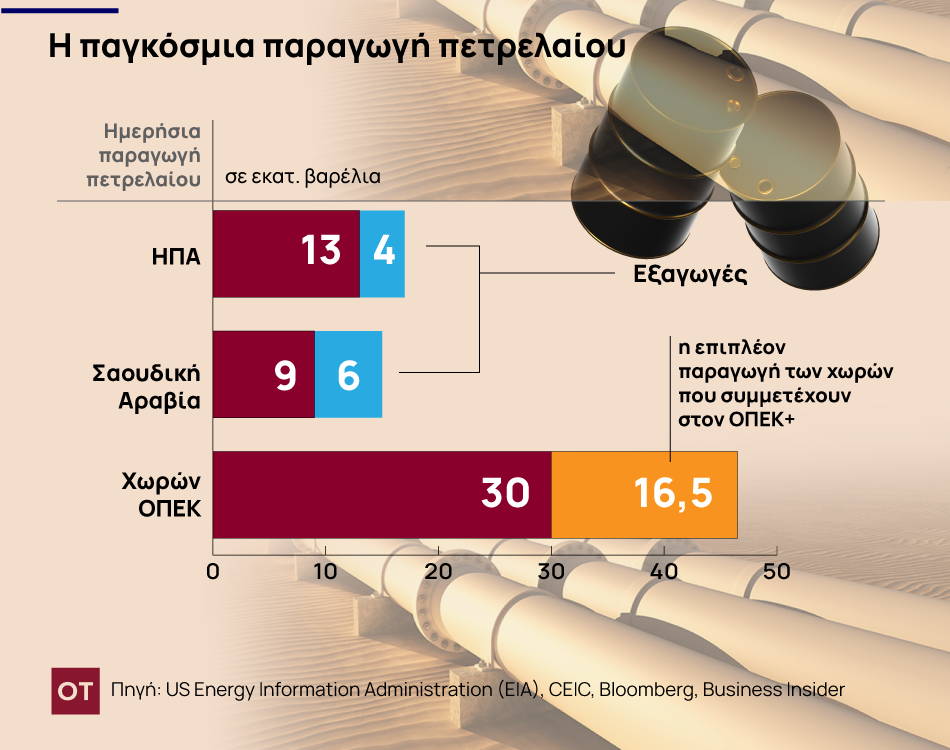

The numbers are revealing for the United States and OPEC+. The United States has accelerated the production of black gold and especially shale oil, making it the country with the largest daily production in the world, which has reached an average of 13 million barrels. Of these quantities, the United States now has the capacity to export approximately 4 million barrels per day, changing market realities. Saudi Arabia remains the world's largest daily exporter – about 6 million barrels out of a total production of about 9 million barrels a day – but the dynamic entry of the Americans into the game has changed the situation.

Saudi Arabia reached production of 11.6 million barrels per day in April 2020, which is a historical record for the country. The lowest it ever produced was 7.12 million. barrel in early 2002.

For this reason, in an attempt to keep prices artificially high, OPEC+ sought to successively reduce the quantities of oil that its members put on the market, by 1.3 million barrels initially and by 2.2 million barrels thereafter. Total global demand for black gold on a daily basis is just under 100 million barrels.

OPEC (Angola, Algeria, Gabon, Republic of Congo, United Arab Emirates, Equatorial Guinea, Iraq, Iran, Kuwait, Libya, Nigeria, Saudi Arabia and Venezuela) produce a total of 30 million barrels per day, while Russia, Mexico, Kazakhstan, Oman and other OPEC+ countries produce about an additional 16.5 million barrels.

However, OPEC has to deal with its internal problems as Riyadh seeks to impose production quotas and support prices. With its allies Russia and other countries that are not official members of OPEC+, Saudi Arabia does not always face an easy task in the negotiations in question. Just last week, Angola announced its decision to withdraw from the organization starting in the new year. The decision represents a blow to the Saudi-led OPEC, which has struggled in recent months to muster support for further production cuts. Angola has announced that the agency no longer serves the country's interests.

All of this does not seem to have much impact, at least for now, on US shale oil producers who are working to steadily increase their production. This increase in production and especially exports has been felt around the world and is seen as calling into question the OPEC+ group's strategy to limit supply. Despite the problems they have faced in the past due to significant price declines, mainly due to the pandemic, shale producers in the run-up to 2024 appear to retain significant leverage to gain a share of the cartel to continue the trend that began in 2023.

However, the balance is still delicate. Saudi Arabia may decide in the future to put more pressure on American producers and wage a more intense supply war in the market, offering better prices to customers. Saudi Arabia and its other allies in the Middle East typically have the advantage of being able to produce oil at a lower cost than producers such as those in the United States or in offshore areas where costs are higher.

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..