The construction industry is on the verge of a nervous breakdown, with material prices rising every month.

Construction emerged from the recession of the economic crisis, with contractors “building” new residential buildings with modern specifications, especially in the northern and southern suburbs.

Real estate: 212 thousand homes “missing” from the market

There is no end to the rise in the value of building materials, which has led to a decline in the cost of construction of new buildings, but real estate prices in general.

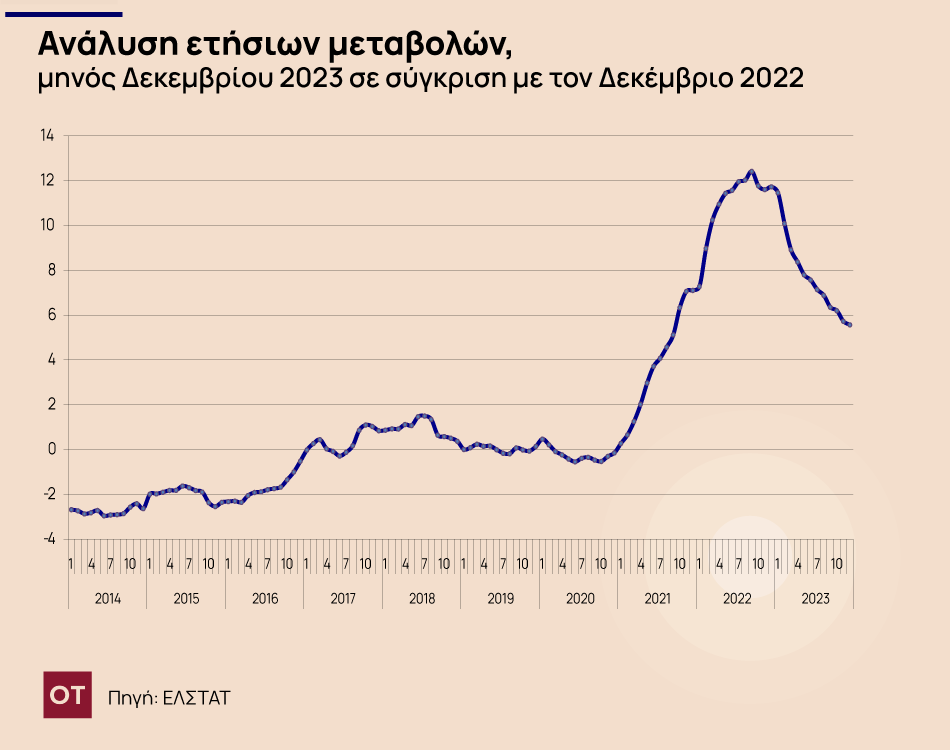

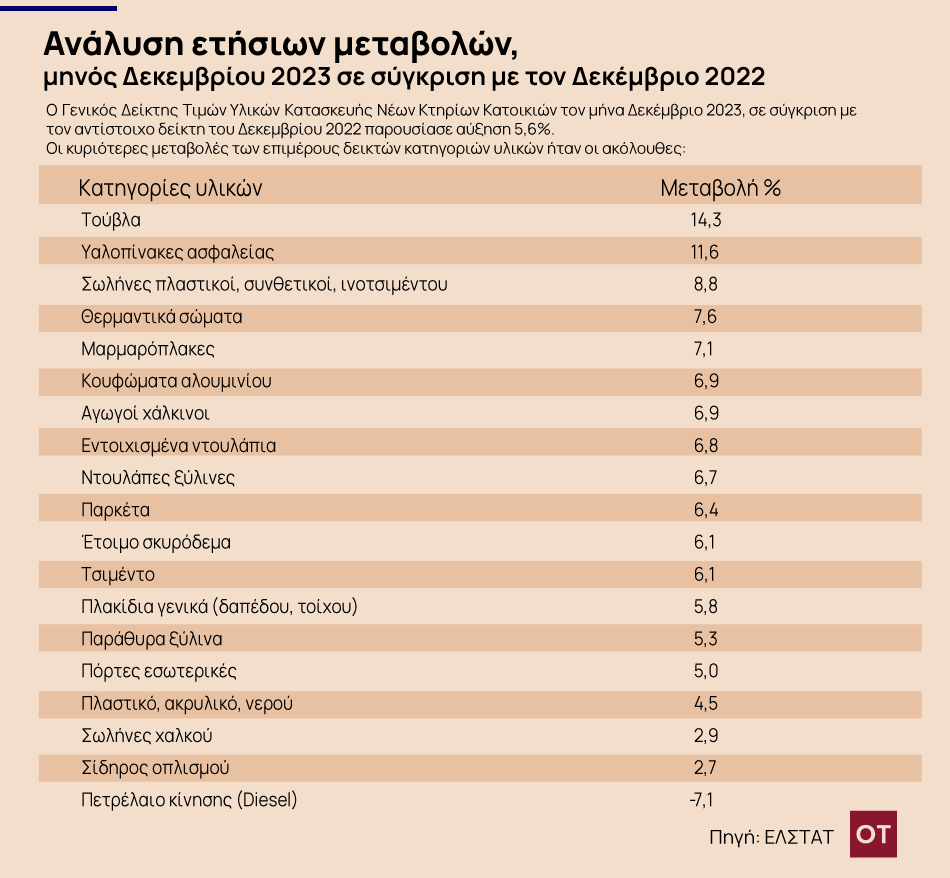

According to Elstat data, the average building materials price index for the twelve months of January 2023 – December 2023 showed an increase of 7.6% compared to the corresponding index for the year 2022, compared to an increase of 11% observed when comparing the previous corresponding twelve months.

Price increases were recorded for, among others, bricks (14.3%), safety glass (11.6%), plastic, industrial and fiber cement pipes (8.8%), radiators (7.6%), marble slabs (7.1%), aluminium. Frames (6.9%), copper pipes (6.9%), built-in cabinets (6.8%), wooden cabinets (6.7%).

Real estate market agents, who spoke to OT, reported that about 3 years ago, when contractors started the procedure for issuing building permits to build a building, they had budgeted that a square meter would cost them about 1,300 euros.

Today, after significant increases in all building materials, the cost of building the building has reached between 2,500-3,000 euros per square meter.

The cost of renovations is correspondingly high, recording unrealistic increases of 50-60% per square meter compared to pre-pandemic levels.

The southern and northern suburbs of Attica as well as the Cyclades Islands are among the most expensive areas in Greece to buy homes in Q4 2023 according to an analysis by Spitogatos Insights based on the Spitogatos Price Index (SPI). More specifically, in Q4 2023, the median asking price for residential sales increased 11.9% compared to Q4 2022.

Among the most expensive areas to buy a house is the municipality of Thessaloniki, while the increasing average asking prices in the Ionian Islands, where the average asking price for houses often exceeds more than 2,000 euros per square metre, is also interesting.

The most expensive area of Attica to buy a house is Vouliagmeni in the southern suburbs, where the average asking price is €18.1 per square meter. and 6,488 euros/sqm. respectively. The Kolonaki-Lykavittos and Glyfada area are also ranked among the most expensive areas in Attica to buy a house.

In Thessaloniki, the most expensive areas to buy a house are Kalamaria (€2,765 per square metre) and Central Thessaloniki (€2,593 per square metre).

The city of Piraeus and its environs ranks highly in the ranking of Attica regions that showed the greatest increases in average asking prices for residential sales during the fourth quarter of 2023 compared to the fourth quarter of 2022.

More specifically, the average asking price in Kalipoli – Vrytida (€2,692 per square metre) increased by 36.3%, while the average asking prices for homes in Drapetsona and Tavros increased by 35.9% and 35.0% respectively compared to the same period in 2022. In New Saichiko, the average asking price for selling homes increased by 35.2% (4,146 euros per square metre). A significant increase of 33.3% was also recorded in Ilion (€2,000/sqm).

search

Greeks appear pessimistic about real estate prices this year. As a special survey conducted by the European Central Bank showed, citizens in Greece are preparing for new significant increases in property prices this year.

According to the survey, citizens estimate that house prices will rise over the next 12 months by more than 8%, a rate four times higher than in the eurozone, where the average increase is expected to be 2.2%, just below 2.4% in 2018. The corresponding ECB survey in November.

These expectations are clearly linked to the rise in prices on the Greek market in recent years, despite the significant increase in mortgage interest rates, while there has been a noticeable slowdown in the Eurozone and falling prices in some countries.

the reasons

A study examines the causes of “inflation” of housing prices in Greece, and highlights the huge gap between supply and demand.

According to Piraeus Bank, the search for the factors that led to this large discrepancy leads us to the conclusion that the developments witnessed by the Greek economy during the years of crisis and recession created a major imbalance between supply and demand for residential real estate, which will unfortunately be difficult to overcome in the short term.

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..