The Hellas Of the 21 countries in Europe, it is the only one that, according to the 2021 European Union Public Housing – Cooperative and Social Survey, does not have an affordable housing infrastructure.

Almost all European countries are registering Rapid increase in rental demandalthough many of them adopted as early as 2018-2019 new measures and policies aimed at reducing housing costs.

It should be noted that many countries already have active programs and structures aimed at affordable housing.

Housing costs are “burning” in Greece

Greece is, among 21 countries in Europe, the only one that, according to the 2021 European Union Public Housing – Cooperative and Social Survey, does not have an affordable housing infrastructure.

according to Themistoklis Baka, Head of Hellenic E-Real Estates Network, This is it “My reason is, because Greece is late, our country will start implementing housing cost containment policies basically within 1u Quarter 2023, measures that require a significant implementation time (2-3 years) and are not intended to immediately curb housing costs and/or ease the family budget. At the same time, even if it is fully implemented, it targets a limited number of beneficiaries in relation to the real need today, but also to the needs that will arise in the coming years.”

Rising rents – increase close to 50%

From 2018 to today, the increase in family-friendly rents has ranged from 37.2% to 42.1%.

Mr Backas confirms Newsbomb.gr that Higher increases in required rents were recorded mainly in properties with smaller surface area. A recent survey reported that required rent for student accommodation increased by 53% in Athens between 2017-2022, while in Patras, which ranked second on the list, it increased by 47%. % -49%.

The cost of housing in Greece has risen to levels of up to 60%-70% of the average monthly salary, one if it is adequate housing for a family, all salary is “good”. Now, a large part of our fellow citizens is forced to make cuts even in their most basic needs. According to a recent survey, 76.9% of renters, if they pay for the home, take discounts or receive financial assistance from third parties.

The home ownership rate in Greece has decreased

The myth that Greece has the highest homeownership rate in Europe has been dispelled according to Eurostat data. Greece for 2020 ranked 19The The position is among 33 European countries that lost 17The The position he held in 2019” Mr. Bkass explained and continued:

“Between 2005 and 2021, the percentage of homeownership in our country decreased from 84.6% to 73.3%, losing 11.3 percentage points according to Eurostat data. The lowest ownership percentages were recorded in 2014 at 74%. The above data records the negative effects of the memorial years in our country In 2015, the home ownership percentage in Greece was 75.1% with negative fluctuations in the following three years (2016, 2017, 2018), while in 2019 it increased to 75.4%.

The President of the Panhellenic e-Real Estate Network commented “From 2020 to the end of 2021, our country lost 2.1 percentage points against 82,947 homes (3,949,900 housing units in 2019 – Eurostat). A significant part of the above homes were “lost” due to the start of auctions, as well as due to the pandemic crisis. At the same time, perhaps Part of the property owners who have debts to banking institutions may have “wanted” to pay off the amount of the debt by selling their property, choosing to live in an apartment that is now rented.

In addition, we can say that a part of the owners chose to “exploit” their property through short-term rentals and/or sell their homes due to increased selling prices to local or non-local investors, who may not own the property.

Acceptance of short-term rent as a reason for reduced home ownership cannot be proven. Because in 2019, which was also the best year for the sector, the percentage of occupied home ownership was higher than it was in 2020 and 2021. Let’s not forget that 2020 and 2021, due to covid-19, were not the best years for the short-term rental sector to record An increase in the number of rents.

The decline in the percentage of homeownership in our country tends to intensify, due to the “liberalization” of auctions even for debts of less than 30 thousand euros, limited dynamics – the inability of a large part of our citizens to obtain residence with the aim of owning a home.

The red loan management companies have, according to reports, 700,000 of all categories (housing, shops, industrial premises, plots of land, etc.), valued at more than 40 billion euros.

Today, a large portion of the aforementioned properties is still registered in E9 for debtors. If the property is housing, then a significant part of it will be occupied by two owners and at the same time it will be counted in the owner-occupation percentage in our country. When the auction is successfully completed, only then does ownership of the property change.

It is worth noting that according to 2021 reports, seven out of 10 properties that are under the hammer still end up in auctions, i.e. banks and workers.

According to reports, more than 17,500 housing auctions were held in the first half of 2022 alone, while the target for the whole year is 40,000 housing units.

A representative of a claims management company stated in an interview that 20%-25% of all properties they own will gradually be put up for sale in the next five years.

If 25% to 30% of 700,000 properties are liquidated in the coming years, that is, about 200,000 properties will be sold through auctions, which is a key tool for achieving the goals set in the operational plans of the funds and management companies that have implemented them, we are all aware of the rapid decline potential in the property rate in our country in the coming years.

At present, when most buyers are either ‘partnership’ funds, domestic or private investment schemes, or individuals, most aim not to own the property, but to exploit the property.”

The highest average cost of housing in Greece (2021)

With the rise in housing prices, the cost of housing is no longer affordable.

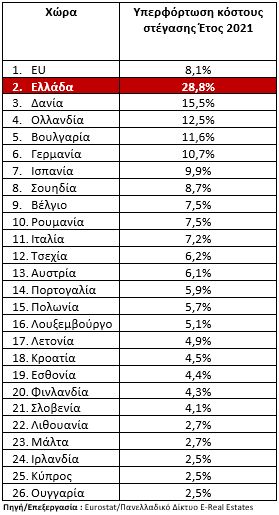

The total cost of housing is More than 40% of disposable income for a large percentage of the population. In the European Union in 2021, 8.1% of the population lived in such a household. The highest rates of housing cost overload were observed in Greece (28.8%), Denmark (15.5%), the Netherlands (12.5%), Bulgaria (11.6%) and Germany (10.7%). “, Mr Backas said.

Day 23The A position for tenants in Greece who live in accommodation with reduced or free rent in all 27 European countries

He indicated how “According to Eurostat data, only 5.6% of renters in our country live in housing that has a lower cost of rent compared to the free rental market or live for free. Greece 21 years agoThe In 2020, it dropped 2 places in the table standings for 2021. At 1The The place with the highest percentage of tenants paying reduced rent and/or living free is France with 21%, while the top five is completed by Slovenia with 19.8%, Ireland with 17.2%, Cyprus with 16, 4% and Finland with 14.8%. The above data shows the lack of a broad housing policy in our country.

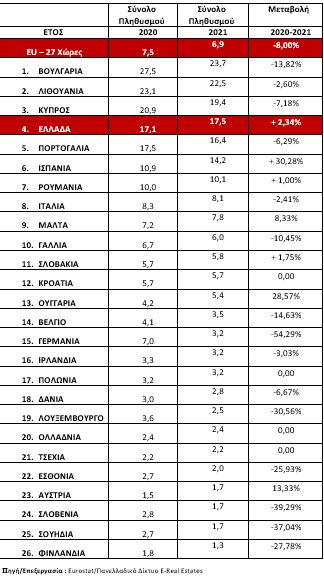

in 4The Place Greece with the percentage of the population that cannot keep their homes adequately heated

For Greece, it ranks fourthThe (from 6The in 2019) in the table of 26 European countries, Themistocles Pacas said, “Because 17.5% of the total population in 2021 could not keep their homes warm enough, while the average percentage of the population in Europe does not exceed 6.9%. In 1The The center is Bulgaria with 23.7%, Lithuania with 22.5% and Cyprus with 19.4%. It should be noted that Greece is the only country among the first five countries in the table that recorded an increase in its prices in 2021, unlike Bulgaria, Lithuania and Cyprus, and according to reports, it has increased electricity bills overdue for more than 45 days. to 45% from 20% in the pre-crisis period, which means that almost one in every two consumers is struggling or unable to pay the electricity bill even after subsidies. Delinquent consumer debt to service providers, based on RAE calculations, exceeds €1 billion.”

Proportion of the population unable to keep the home sufficiently warm

Inflation, rising construction costs putting upward pressure on sales prices, rising mortgage rates, skyrocketing rents, energy costs, rising commodity prices are curtailing the disposable income of potential buyers who aim to cover their housing needs by purchasing a home, while at the same Time directly affect the cost of living.

Finally, Mr. Bakas explained how “The economic challenges in the global community as well as in our country are significant and there is a need for expanded housing policies immediately, policies aimed at curbing next-day costs and access to the housing market, but at the same time, policies with 2-3 years of implementation, which will aim to Disposal of private data in the future, as well as measures that would “protect” property in conditions of an unhealthy economic environment.

The provision of housing is a duty of the state and falls within the scope of the state’s social policy.

Read also:

Rents: increased 7 +1 reasons in the last year

Rents: at least 600 euros for a two-room apartment in Athens

Rent: Students and families in “desperation” this year

More Stories

F-16 crashes in Ukraine – pilot dies due to his own error

Namibia plans to kill more than 700 wild animals to feed starving population

Endurance test for EU-Turkey relations and Ankara with Greece and Cyprus