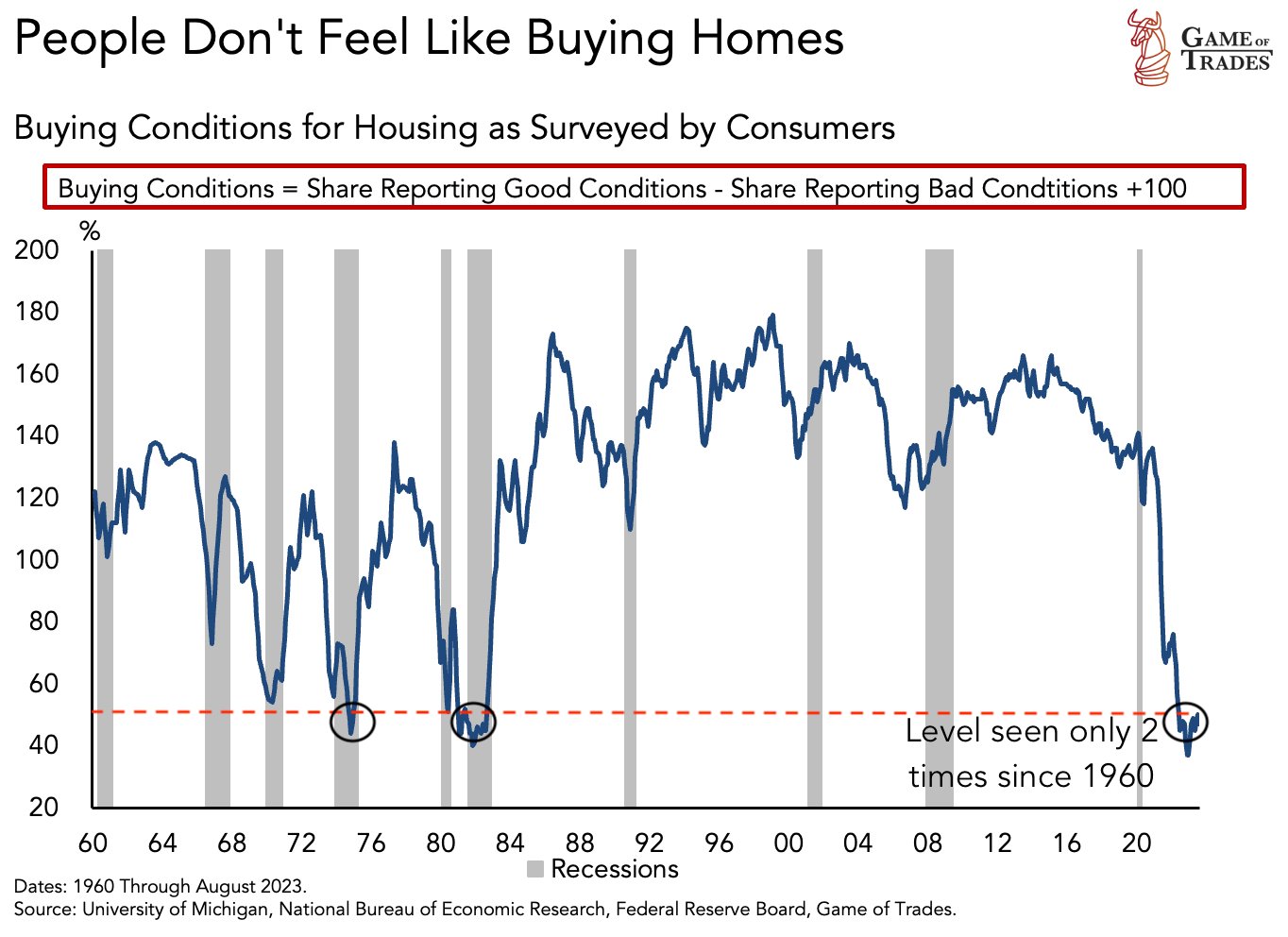

However, we have seen such poor conditions in the American real estate market since 1960…

An unexpected, as usual, prediction about the future of the US stock market was made by the now famous author of financial books Robert Kiyosaki -In fact, it caught our attention…

More specifically, Kiyosaki believes that Airbnb will lead to the collapse of the Wall Street real estate market, and thus for those who want to invest or acquire new homes for their own use, new, brighter days may come.

AIR B&B to lead the real estate market collapse. If you want a new home, your happy days are just around the corner. Same for rental properties. The best time to get rich is to get into an accident. good luck.

– Robert Kiyosaki (@theRealKiyosaki) September 6, 2023

It is reported that Airbnb was recently listed in the US stock market S&P 500 Barometer Index with Blackstone.

In order to be included in the S&P 500, companies must be highly liquid U.S. companies, have a market capitalization of at least $14.5 billion, and meet profitability, liquidity and equity criteria.

In any case, US real estate is not in good shape.

For many US cities, the effects of the pandemic continue to impact their markets.

It is noteworthy that in a weak housing market there are usually more homes for sale than buyers who want to buy them, causing real estate prices and values to decline.

In the worst-case scenario, which is what Kiyosaki sees, the problem in question will negatively affect many American cities.

Lower prices mean that owners no longer have an incentive to invest in improvements.

Also, as home sales decline in an area, businesses often move elsewhere.

Both issues make the problem worse and ultimately cause a downward spiral that is difficult to stop.

The reason behind this problem is that mortgage rates have risen significantly over the past two years as the Federal Reserve has addressed rising inflation with a series of large interest rate increases.

The effects of monetary tightening have put strong pressure on the housing market, pushing mortgage interest rates above 7% (now hovering around 6.3%).

But as the housing market slowed, so did Americans’ expectations about home values in their area, according to a Gallup poll.

Last year, 70% expected house prices to rise in their area in 2023, while only 56% are of the same opinion this year.

The survey also indicates that after the housing market crash of 2009-2012, 22-34% believed that home values would rise.

However, we have witnessed such bad conditions since 1960…

Interest in Bitcoin

In his latest predictions, Kiyosaki claims that recessions present unique opportunities for wealth accumulation.

Despite his insistence on predicting an imminent financial market crash, his recipe for navigating these turbulent times remains the same.

According to the author, there are three assets that can serve as a financial lifeline during these uncertain times: gold, silver, and bitcoin (BTC).

Kiyosaki’s interest in Bitcoin is particularly noteworthy.

According to him, its value is expected to rise — perhaps, he says, to $120,000 by 2024 and $500,000 by 2025.

Bitcoin to 100 thousand dollars. Saying for years, gold and silver are God’s money. $Bitcoin Peoples. Bad news if the stock and bond market crashes and gold and silver rise. Worse news if the global economy collapses bc $1 million in gold and $75,000 in silver to $60,000. Savers for fake US dollars. Debt is very high. Mom, pop and kids in…

– Robert Kiyosaki (@theRealKiyosaki) August 14, 2023

The author attributes these expectations to excessive money printing by the United States, a phenomenon that has raised concerns about inflation and the long-term stability of traditional currencies.

Investors and fans are certainly watching Kiyosaki’s predictions closely, as his unconventional scenarios – even if just for fun – are always interesting.

And in these uncertain times, Kiyosaki’s remarks may offer a different perspective for individuals navigating the complex corridors of investing and preserving wealth.

www.bankingnews.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..