A blink and you missed it, but the yield on the two-year Treasury briefly traded above the yield on the 10-year bond on Tuesday afternoon, temporarily inverting the yield curve and setting off recession warning bells.

The data shows that it hasn’t paid in the past to part with stocks the moment the Treasury yield curve turns upside down, with short-term returns higher than long-term returns.

Not a good timing tool

“While it is a good indicator of future economic problems, the inverted yield curve has not been a very good timing tool for equity investors,” Brian Levitt, global market analyst at Invesco wrote in a March 24 note.

“For example, investors who sold when the yield curve first inverted on December 14, 1988, lost a subsequent 34% gain in the S&P 500,” Levitt wrote. “Those who sold when it happened again on May 26, 1998 lost an additional 39% of the market rally,” he said. “In fact, the average return for the S&P 500 index from history in each cycle when the yield curve is inverted to the peak of the market is 19%.” (See table below).

Invesco

Investors certainly didn’t head for the hills Tuesday. US stocks Ended with strong gainsbased on the bounce from early March lows to the S&P 500 SPX push,

To exit the market correction that entered in February. Dow Jones Industrial Average DJIA,

It jumped 338 points, or 1%, while the Nasdaq Composite jumped,

advance 1.8%.

Read: S&P 500 out of correction: Here’s what history says happens next to the US stock market index

Coups and what do they mean?

The yield curve, the line that measures returns across all maturities, usually slopes upward due to the time value of money. The inversion of the curve indicates that investors expect long-term prices to be lower than near-term rates, a phenomenon widely seen as a signal of a possible economic downturn.

But there is a lag there, too. Levitt noted that the data, going back to 1965, shows that the average time between a reversal and a recession was 18 months — which matches the mean stretch between the start of a reversal and the top of the S&P 500.

Furthermore, the researchers argued that continuous reversal is necessary to send a signal, something that has not yet happened, but is still widely expected.

Which curve?

Two-year reversal TMUBMUSD02Y,

/ 10 years TMUBMUSD10Y,

Ross Mayfield, Baird’s investment strategy analyst, said in a note Monday that the yield curve measurement has preceded all six recessions since 1978, with only one false positive.

The researchers noted that the 3-month/10-year spread was seen as equally, albeit slightly, more reliable and was more common among academics. At the Federal Reserve Bank of San Francisco. Federal Reserve Chairman Jerome Powell earlier this month expressed a preference for a more targeted measure in the short term that measures 3-month rates versus 3-month rate forecasts 18 months into the future.

Mayfield noted that the 3-month/10-year difference was “far from reversible.”

In fact, the difference between the two closely watched metrics for the curve has been a scratch for some market watchers.

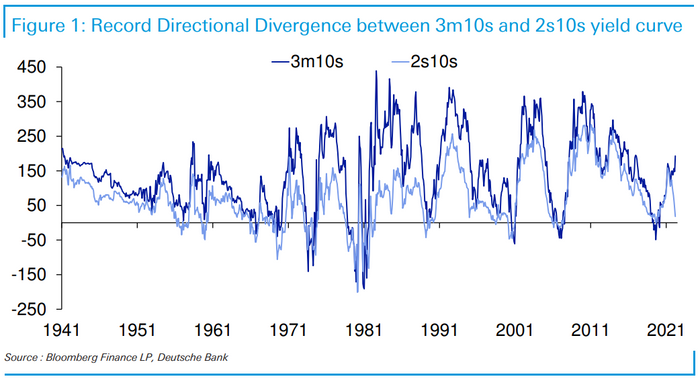

“The remarkable thing is that the two went head-to-head until about December 2021 when 3m/10s started declining as the 2/10s collapsed,” said Jim Reed, strategist at Deutsche Bank, in a note on Tuesday. ).

German Bank

“There wasn’t such a difference in direction probably because of the Fed [has] Reed said. “If the market pricing is right, they will catch up quickly over the next year, so it is possible that the 3-month/10-year metric could be flat as interest rates rise in the short term as the Fed raises its benchmark policy rates.

The takeaway, Mayfield wrote, is that the yield curve is still a strong indicator and at least indicates a cold economy.

“Volatility must remain high and the benchmark for investment success raised. But in the end, we believe it is worth taking the time to understand the bigger picture and not relying on any one indicator.

In one scheme: ‘Finally breaking the dam’: 10-year Treasury yields surge to break top of downtrend channel seen since mid-1980s

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..