Wall Street drops after a negative macro…

drop Its main indicators moved Wall Street On Thursday, July 6, after data on the track of unemployment benefits…

The Fed’s hawkish messaging and the US-China trade war have also had a negative impact

In this context, the industrial index Dow Jones It fell 1% to 33,922 units.

Indicator – barometer Standard & Poor’s 500 It fell 0.8 percent to 4,411 units.

technical Nasdaq It decreased by -0.82%, to 13,679 units.

performance tTwo-year US bonds Levels reached which has not been observed for 16 yearsas investors weighed the strong jobs data indicating further tightening by the Federal Reserve.

The two-year US rose more than 11 basis points to 5.063%.

Meanwhile, the yield on the 10-year note was trading at 4.037%, after jumping 9 basis points.

“Almost everyone noted that in their economic projections, additional increases in the federal funds rate targeted through 2023 would be appropriate.” Show the Federal Reserve minutes.

In addition, there were some policymakers who favored raising interest rates at the June meeting, when the US central bank ended its annual tightening cycle amid concerns about the strength of the labor market and “unacceptably high” inflation.

Concerns that prolonged high interest rates will push the US economy into recession have weighed on most developed stock markets, given the importance of the world’s largest economy as an engine of global growth.

Meanwhile, investors are awaiting US Treasury Secretary Janet Yellen’s visit to China, given the threat of an escalation in the trade conflict between the two countries after China imposed restrictions on exports of key chip-making materials to the US earlier this week.

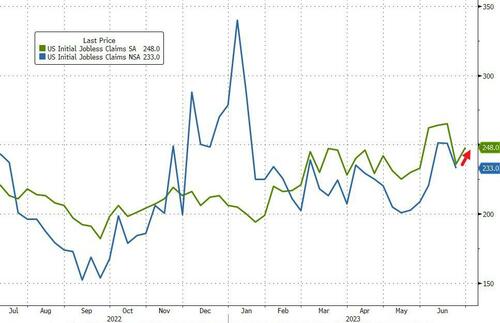

sta preciseThe number of new jobless claims in the USA increased to 248K vs. 236K previously.

Economists expected about 245,000.

After last week’s unexpected drop – reportedly due to June’s revisions – initial jobless claims were expected to rebound last week (despite the surprise increase in ADP jobs data) and they did.

The US services sector expanded faster-than-expected in June as new orders rose, but an index of the prices businesses paid for inputs fell to a three-year low.

The ISM non-manufacturing PMI rose to 53.9 last month from 50.3 in May.

Any reading above 50 indicates growth in the services sector, which accounts for two-thirds of the US economy.

Analysts polled by Reuters had expected the index to rise to 51 points.

This was the sixth consecutive month of gains for the index.

The new orders index strengthened to 55.5 from 52.9 in May.

The index, which measures the prices paid by firms in the services sector for inputs, fell to 54.1 from 56.2 in May.

The Fed and China sent the Euro markets lower

The Fed’s hawkish messages and the US-China trade war sent international stock markets plummeting.

in frankfurt o Dax It fell 2.57%, to 15,528 units.

in London FTSE 100 index It posted a loss of 2.17% at 7,280 units.

At 7,082 units, a decrease of 3.13%, the CAC 40 In Paris.

the FTSE MIB In Milan it fell 2.53% to 27,506 units.

www.bankingnews.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..