the Today’s crisis It stems from the impossibility of serving teof debt accumulated by the United States Which currency bubble which they created

the The banking crisis is not a problem of the quality of credit conditionsBut now an impossible feat comes from her Financing of the expanding US foreign debt

The American banking system is broken.

this does not mean that mrOther “giants” of the financial sector, Credit Suisse, were also destroyed.

Central banks will keep moribund institutions in the … intense.

But the the era of dollar-based currencies and floating exchange rates that began on August 15, 1971; When the United States severed the link between the dollar and gold and canceled the Bretton Woods agreement, is coming to an end.

Loss will be transferred aFrom banks to the real economywhich would be… hungry for credits.

and the The geopolitical consequences would be enormous.

Multipolar system of foreign exchange reserves

The collapse of the dollar financial system will accelerate the shift to pThe comprehensive system of foreign exchange reserves with the emergence of the Chinese yuan as a competitor to the dollar.

the goldthe A “barbaric relic” hated by John Maynard Keynes, It will play a bigger role because the dollar banking system is broken and no other currency – certainly not the tightly controlled yuan – can replace it.

Now close to An all-time record price of $2,000 an ounce, Gold is likely to rise further.

negative net worth

The greatest threat to the dominance of the dollar and the strategic power it conveys to Washington is not China’s ambition to expand the international role of its currency.

The risks come from the exhaustion of the financial mechanism that has enabled the US to manage a negative net foreign asset position of $18 trillion over the past 30 years.

Deutsche Bank case

symbolic institution of germany, deutsche bank, History presented Low 8 euros on the morning of March 24thbefore recovering to 8.69 euros at the end of that day’s trading, andThe cost of debt insurance (the so-called CDS) jumped to about 380 basis points above LIBOR, or 3.8%.

This is close to the performance during the 2008 banking crisis and the 2015 European financial crisis, though not as much as during the close of March 2020, when the premium in question was over 5%.

Deutsche Bank will not collapse, but it may need official support.

You may have already received such support.

Because this crisis is different

This crisis ecompletely different from 2008, When banks amassed trillions of dollars in assets that bThey counted on “loan bubbles” in the real estate market.

Fifteen years ago, the credit quality of the banking system was… rotten and The leverage was out of control.

Bank credit quality today is the best in a generation.

The crisis stems from the impossible mission of xIn reference to America’s expanding foreign debt.

h Warning from the Bank for International Settlements

It is also the most predictable financial crisis in history.

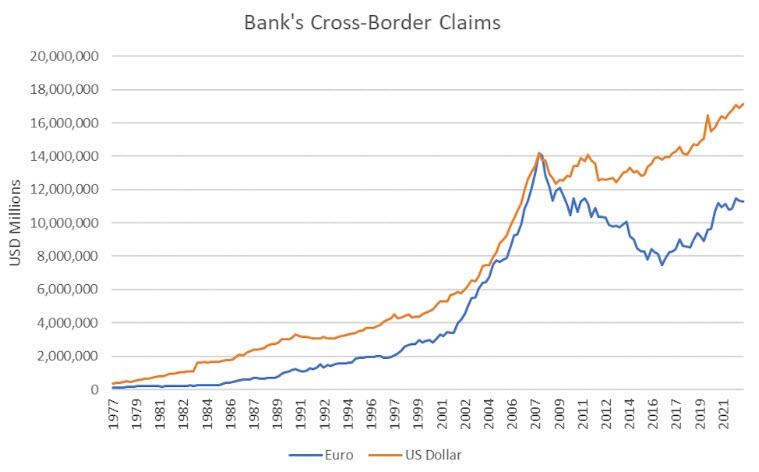

the 2018the Bank for International Settlements (a type of central bank for central banks) be warned The $14 trillion in short-term dollar loans from European and Japanese banks used to hedge currency risks was…a time bomb waiting to explode.

In March 2020, dollars in credit ran out when the Covid lockdowns began, causing a sudden shortage of bank financing.

The Federal Reserve put out the fire by opening billions of dollars worth of swap lines to foreign central banks.

He extended these interchange lines on March 19 of the same year.

respectively, Dollar stocks rose in the global banking systeme, as measured by Claims volume offshore in the global banking system.

This caused a new security vulnerability, That is, the so-called counterparty risk, or exposure of banks to huge amounts of short-term loans to other banks.

Shopping…with money in the air

years eThe US current account deficit over the past 30 years It amounts to an exchange of goods…on paper…

theThe United States buys more goods than it sells and sells assets (stocks, bonds, real estate, etc.) to foreigners to make up for it.

America is now a net city 18 trillion dollars for foreigners, Roughly equal to the cumulative sum of these deficits over 30 years.

The problem is that foreigners who own assets in the United States They receive cash flows in dollars but have to spend the money in their own currencies.

With exchange rates fluctuating, The dollar value of cash flows in euros, Japanese yen or Chinese yuan is uncertain.

Foreign investors must hedge their income in dollars, that is, short sell US dollars against their currency.

This is the reason tThe size of the foreign exchange derivatives market has grown along with US foreign liabilities.

The mechanism is simple: If you receive dollars but pay in euros, you sell dollars for euros to hedge your currency risk.

But tYour bank has to borrow dollars and lend them to you before you can sell them.

Foreign banks borrowed iUp to 18 trillion dollars from American banks to finance this process.

This creates a huge vulnerability:

If a bank appears to be in trouble, as it did earlier this month, banks will adopt credit limits on a global scale.

Abandon the gold deficit and the current account

Prior to 1971, when central banks kept exchange rates fixedThe United States covered its relatively small current account deficit by transferring gold to foreign central banks at a fixed rate of $35 an ounce, none of which was necessary.

The end of the gold peg to the dollar and the new floating exchange rate regime allowed the United States to do soThey run huge current account deficits selling their assets to the world.

the The populations of Europe and Japan were aging faster than the populations of the United States Conversely, there was a greater need for assets to support pension plans.

This regime is now coming to a roaring end.

As you believe in “Titanic”a

In fact, the market is worried that the US government’s inflation protection is pIf Titanic Passengers Bought…Shipwreck Insurance From The Captain.

The gold market is too large and diverse to be manipulated.

Nobody has much confidence in the US CPI.

The dollar reserve system will be extinguished not with a bang, but with a lot of sighs.

Central banks will step in to prevent any catastrophic failures.

But the Bank balance sheets will shrink, credit to the real economy will shrink and international borrowing will evaporate.

in this context, Local currency financing will replace dollar credit.

We have already seen this happen in Turkey, whose currency collapsed in 2019-2021 as the country lost access to dollar and euro funding.

so far , Chinese trade finance replaced the dollar and fueled Turkey’s remarkable economic recovery last year.

Southeast Asia will rely more on its own currencies and the yuan.

The new monetary landscape

It is a coincidence that Western sanctions against Russia in the past year have paid off China, Russia, India and the Persian Gulf states to find Alternative financing arrangements for transactions between them.

This is not a critical phenomenon but drThe inefficient, inefficient, and cumbersome way the American banking system operates.

However, the dollar credit goes down Alternative arrangements will become permanent features of the monetary landscape and other currencies will continue to gain strength against the dollar.

www.bankingnews.gr

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..