The Iberian solution could provide more gas to Europe – Spain, Algeria, Libya, the European Union, Morocco, the Sahel, Russia

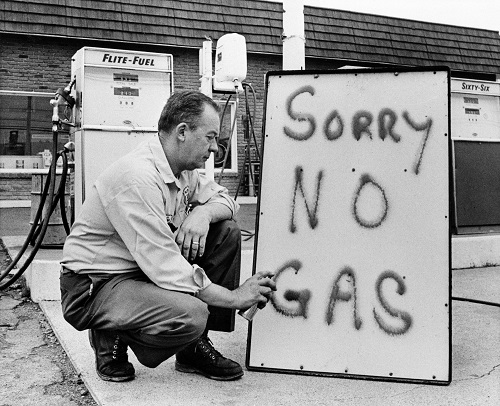

Francis Giles (Vía Fair Observer*) – The Ukraine-Russia crisis has exposed Europe’s dangerous dependence on Russian energy. But it also opened new opportunities for the export of Libyan and Algerian gas.

The question of where Europe’s foreign gas supplies come from and whether there are alternatives to the continent’s dependence on Russia has never been discussed more than in recent weeks. The topic usually reserved for specialists has become the subject of endless discussion. Are there other sources of gas supply to the EU?

The immediate answer is that there are very few today outside of Russia itself, hence the sharp rise in gas prices we have seen recently. But in the medium term, Libya and Algeria have ample scope to increase their supplies to the EU.

Supplies from Libya and Algeria

Libya has proven gas reserves of 1,500 billion cubic meters (bcm). Its production is a modest 16 billion cubic meters. Algeria has 4,500 billion cubic meters of proven reserves and 20 to 25 trillion cubic meters of unconventional gas reserves, the third in the world after the United States and China (and Argentina, whose proven reserves are linked to Algeria). How much gas it can produce is anyone’s guess, but we are talking about a number in the range of tens of billions of cubic meters.

Algeria today produces 90 billion cubic meters, of which 50 billion cubic meters were exported. Another advantage of Algeria is the huge storage capacity – 60 billion cubic meters – of the Hassi Rmel gas field, which is the oldest and largest compared to the storage capacity in the European Union of 115 billion cubic meters.

Pierre Terzian, founder of the French energy research center Petrostrategies, points out that four gas pipelines connect these two products directly to the European continent: the first connects the Libyan gas fields with Italy; The second Algerian gas fields to Italy via Tunisia. The third Algerian gas field in southern Spain. The fourth is the same gas fields to southern Spain via Morocco.

The latter has been closed since November 1, 2021, due to the deterioration of relations between Algeria and Morocco, but this did not affect the gas supply of the Iberian Peninsula. Algeria also has two major LNG terminals, adding flexibility to its export policy. It is exported to France and the UK in LNG carriers.

The first reason for the current crisis is structural, since, according to Terzian, internal gas production in the European Union has decreased by 23% over the past 10 years and covers only 42% of consumption, compared to 53% in 2010. This decline is a consequence of this, on the In particular, the closure of the giant Groningen gas field, which is being well implemented and will be completed by 2030.

Europe has done a lot to expand the gas transport network between EU countries, but there are still some large gas peninsulas. In 2018, he suggested that connections between the Iberian Peninsula and the rest of Europe need to be developed. Spain has a third of Europe’s LNG import capacity, much of it unused, and is connected to Algeria by two major pipelines that can be extended.

As Alan Riley and I noted four years ago, “the main obstacle to opening up supply routes from the Iberian energy market to the rest of the European Union is the restricted route over the Franco-Spanish border. One gas pipeline with a capacity of 7 billion cubic meters is available to transport gas to the north.. The main limiting factor was the political power of Electricité de France, which seeks to protect the interests of the French nuclear industry. We added that the Iberian solution would “benefit not only France and Spain, but also Algeria, by creating additional incentives to explore new gas fields and possibly launch a national revolution.” “Renewable energy”, which would encourage a shift from gas to solar energy consumption. in Algeria.

Germany, Netherlands and Italy

Germany, for its part, has not put its money in its mouth in relation to Algeria. In 1978, Ruhrgas (now absorbed by E.ON) signed a major contract for the supply of liquefied natural gas to Germany. Germany has never built the LNG terminal needed to start this decade. So far, it is the only major European country that does not have LNG import terminals, although it can rely on existing facilities in the Netherlands and Belgium.

In 1978, the Netherlands also committed to buying Algerian gas. Algeria dropped the contract in the early 1980s due to Germany’s refusal to move forward. Later in the 1980s, Rourgas again expressed interest in buying Algerian gas, but the price offered was too low and because Rourgas wanted to install gas through France, which insisted on very high transit fees. By getting rid of Algerian gas, Germany committed itself to Russian goodwill.

Italy, like Germany, the main importer of Russian gas, has positioned itself more skillfully. In December 2021, Sonatrach, the Algerian oil and gas monopoly, increased the amount of gas pumped through the TransMed gas pipeline, which connects Algeria to Italy via Tunisia and the Strait of Sicily, on demand from its Italian customers. This came on the heels of a very successful state visit by Italian President Sergio Mattarella to Algeria in early November. On February 27, Sonatrach confirmed that it may pump additional gas to Europe, but only on condition that existing contractual obligations are complied with.

The relations between the Italian energy company ENI and Sonatrach are historically close due to the important role played by the founder of the Italian company, Enrico Mattei, as an advisor to the Provisional Government of the Algerian Republic in its negotiations with France, which led to the independence of Algeria. In July 1962.

The European Commission’s pursuit of ultra-liberal energy policies since the turn of the last century has destabilized the long-term gas and LNG purchase contract policies, which until then had been the norm in international gas exchanges. However, security of supply is not based on such misguided liberalism. No new gas reserves can be found, let alone brought into production, if European producers and customers are, as Terzian points out, “at the mercy of prices set by trading platforms that have questionable liquidity (and can be affected by the major players). He adds: It’s a ‘limiting irresponsibility’ attitude.

German energy policy has made a strong contribution to the current crisis. He has gladly sought to shut down the country’s nuclear power plants, and increased its reliance on coal for its electricity sector, increasing carbon emissions.

serious conversation

Considering Caspian gas as an alternative to Russian gas, I would like to add another country, Turkey, which has a very aggressive and independent policy as a major gas transit. However, few observers would argue that such a solution would increase Europe’s security.

Engaging in a long-term strategic dialogue with Algeria would give leverage to Spain and the European Union. This could help build better relations between Algeria, Morocco and the volatile Sahel region. When trying to understand the politics of different countries, following money is often a good guide. We can also follow the gas.

*[Cet article a été initialement publié par Arab Digest, une organisation partenaire de Fair Observer.]

the corner05/02/2022

Read also: Africa, Europe’s new gas hunting ground

Read also: What would happen if Russia cut off gas from Europe?

Read also: The closure of the Maghreb-European gas pipeline: a controversy in Morocco

#Spain #Russia #Gas #Algeria #Libya #European Union #Morocco #Sahel

More Stories

F-16 crashes in Ukraine – pilot dies due to his own error

Namibia plans to kill more than 700 wild animals to feed starving population

Endurance test for EU-Turkey relations and Ankara with Greece and Cyprus