Some believe the “Wizard of Omaha” has completed the sale of his stake in the iPhone maker.

Is it a coincidence or is this an investment strategy? About Warren Buffett He owns aExactly the same number of shares of Apple and Coca-Cola. After cutting the tech stocks in the major company in his portfolio in half.

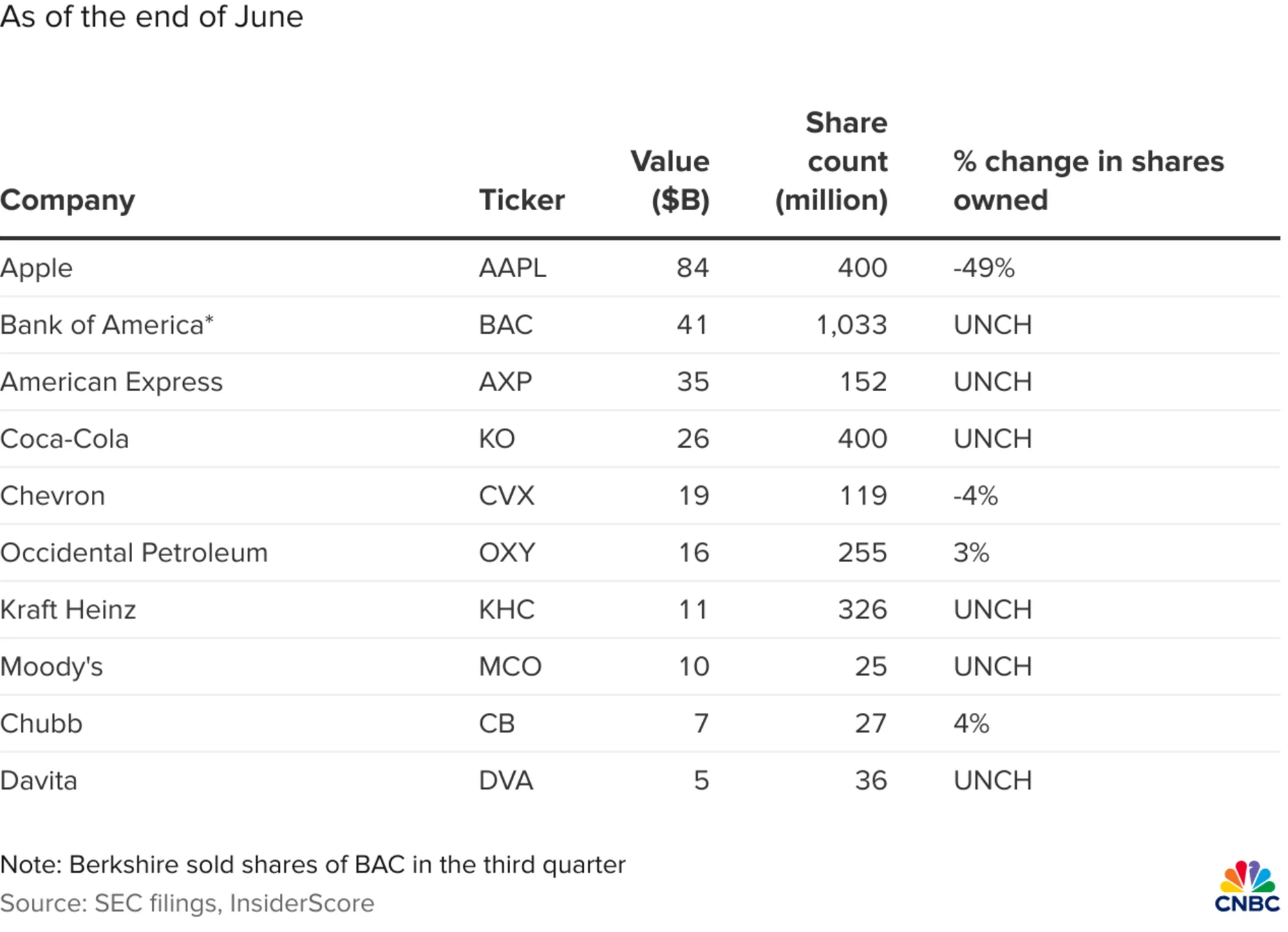

Many of his followers Buffett They did itStrange note after submitting document “13-F” on Wednesday (14/8) And it was revealed in the evening that Berkshire Hathaway From his shares At the end of the second quarter He had the same number. 400 million shares in Apple and Coca-ColaBuffett’s oldest and largest stock holding.

Some have been led to believe that the “Wizard of Omaha” has finished selling his stake in the developer. iPhone.

If Buffett likes round numbers, heYou may not plan to sell additional Apple shares.David Cass, professor of economics at the University of Maryland’s Robert H. Smith School of Business, said.

“Like Coca-Cola is a ‘permanent’ investment for him. Buffettso it could be apple».

The 93-year-old legendary investor first bought 14,172,500 shares of Coca-Cola in 1988 and increased his stake over the next few years to 100 million shares by 1994..

So keep it steady. His stake in Coca-Cola in the same round – number of shares for 30 years.

Due to the 2-for-1 splits in 2006 and 2012, Berkshire’s stake in Coca-Cola reached 400 million shares.

Buffett said he discovered the popular soft drink when he was just 6 years old. In 1936, Buffett began buying six Coca-Colas at a time for 25 cents each from his family’s grocery store and selling them around the neighborhood for an extra five cents.

Buffett noted that that was when he realized it. “Excellent consumer appeal and commercial potential of the product.”

Apple share reduction

Investing in high-tech companies such as Apple appears to be defying Buffett’s long-standing principles of value investing, But the famous investor treated it as a consumer products company like any other. Coca-Cola is not a technology investment.

the Buffett It announced its loyal customer base. iPhoneSaying that people will give up their cars before they give up their smartphones.

He even called Which made Apple the second most important company after Berkshire’s insurance group.

So it came as a shock to some when it was revealed that Berkshire was giving up its 49% stake in the iPhone maker in the second quarter.

Many suspect it was part of portfolio management or a broader market outlook rather than a move to neglect Apple’s future prospects.

And reduce the sale weight Apple in Berkshire’s portfolio to about 30% from about 50% At the end of last year.

By arranging this circular number, It seems to have reached a stage where Buffett prefers his beloved and long-held stocks.

However, some have said it may just be a coincidence.

“I don’t think Buffett thinks that way,” Mr. Hans said. Bill Stone, Chief Investment Officer of Glenview Trust Company and a Berkshire shareholder.

But at Berkshire’s annual meeting in May, Mr. Buffett compared the two and stated that the holding period for both assets was unlimited.

We have her shares. coca cola, “It’s a great investment,” he said. Buffett .

The same applies to her. appleit’s a better company, and we’d be comfortable owning its stock unless something really extraordinary happened, i.e.In the future we have jobs at Apple and American Express, but also at Coca-Cola.”.

www.bankingnews.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..