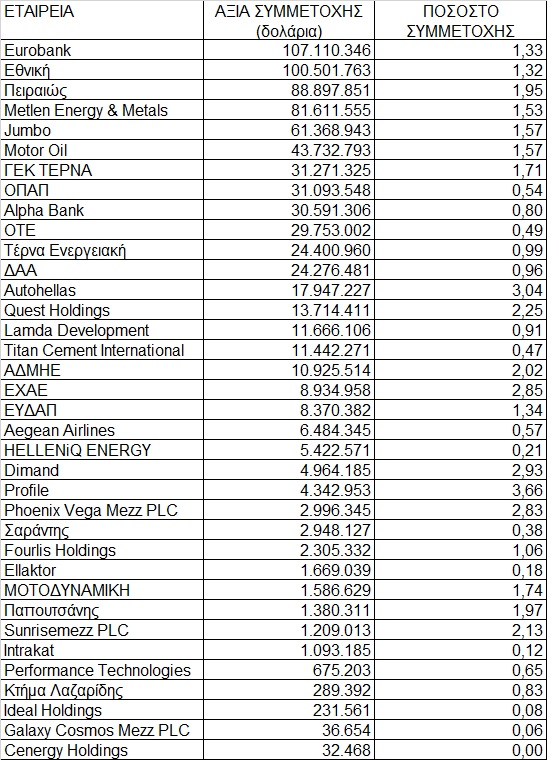

Norway’s sovereign wealth fund, with firepower $1.7 trillion He has properties in 36 listed On the Greek stock exchange, as shown by recently published data. The value of its positions exceeds $775 million.

Three banks (Eurobank, Ethniki, and Piraeus) occupy the largest positions in terms of value, while the fourth Metlin. He finally owns about 1.53% of the capital, and the value of the position exceeds $81 million.

It is not the only company in the energy sector. The treasury has also been placed in it. Engine Oil, Terna Energy and Hellenic EnergyHe owns 2% of its capital. human, But also participate in intranet

Of particular importance is that the Fund has recently focused its attention on energyIt increased its position in its three largest energy holdings — Exxon Mobil, Shell PLC and BP PLC — while reducing its exposure to Tesla and Volkswagen.

The fund traditionally provides an annual update of its portfolio contents, but will do so twice a year from now on. It was set up in the 1990s to invest Norway’s oil and gas revenues abroad.

He has shares in more than 8800 companies Worldwide based on data at the end of June, by approximately 72% All investments will be in stocks and 26% in fixed income.

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..