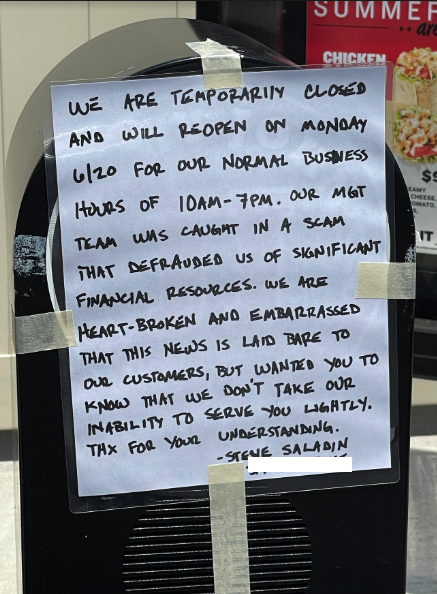

Check Out This Handmade Banner Hanging On Your Shutter Front Door Jimmy Jones Chain store sandwiches in Missouri last week. See if you can find out what happened from the store owner’s message.

If you thought someone at Jimmy John’s store might have fallen victim to Business Email Reconciliation (BEC) or a “CEO scam” scheme – where fraudsters impersonate company executives to steal money – will be in good company.

In fact, this was my initial assumption when a reader in Missouri shared this photo after being turned away from his favorite local convenience store. But a conversation with the store owner Steve Salahuddin He brought back the fact that some of the best anti-fraud solutions are less technical than BEC scams.

Visit any random establishment for fast food and there’s a good chance you’ll see a sign somewhere in the management telling customers that their next meal is free if they don’t receive a receipt for their food. While it may not be obvious, such policies are meant to deter employee theft.

The idea is to force employees to finish all sales and create a transaction that is recorded by the company’s systems. The show also incentivizes customers to help keep employees honest by reporting that they haven’t received a receipt for their food, because employees can often hide transactions by canceling them before they are complete. In this scenario, the employee gives the customer his food and any change, then puts the rest into pockets.

You can probably guess by now that this Jimmy John franchise – in Sunset Hills, Mo. – He was among those who chose not to incentivize their customers to insist on receiving receipts. Thanks to that oversight, Salahuddin was forced to close the store last week and fire husband-and-wife managers for allegedly embezzling nearly $100,000 in cash payments from customers.

Salahuddin said he began to suspect something was wrong after he agreed to take on Monday and Tuesday shifts for the couple so they could have two consecutive days of rest together. He said he noticed that the cash receipts at the end of Monday and Tuesday nights were “much larger” than when he wasn’t managing the fund, and that this was consistent over several weeks.

Then he had friends come forward for a car ride from his restaurant, to see if they had received receipts for cash payments.

“one of [the managers] He will take an order in the car, and when they decide that the customer will pay in cash, the other will make the customer change on it, but then delete the order before the system can complete it and print a receipt,” Salahuddin said.

Salahuddin said his lawyers and local law enforcement are now involved, and he estimates that former employees stole nearly $100,000 in cash receipts. This was in addition to the $115,000 in salaries he was paying in total each year to both employees. Saladin also has to figure out a way to pay his franchisee a fee for each stolen transaction.

Now Saladin sees the wisdom of adding the receipt tag, and says that all of his stores will soon carry a sign offering $10 cash in to any customer who reports not receiving a receipt with their food.

Many business owners are reluctant to engage the authorities when they discover that a current or former employee has been robbed from them. Oftentimes, organizations that fall victim to employee theft are reluctant to report it because they fear that any media coverage resulting from the crime will do more harm than good.

But there are quiet ways to ensure hackers get their due. A few years ago, I attended a presentation given by an investigator in the criminal division of we Department of Internal Revenue (IRS) who suggested that any embezzlement victims seeking a confidential law enforcement response should simply contact the IRS.

The agent said the IRS is obligated to investigate all notifications it receives from employers about unreported income, but embezzlement victims often ignore the agency’s notification. That’s a shame, he said, because under US federal law, anyone who willfully attempt to evade or eliminate taxes can be charged with a felony, including fines of up to $100,000, imprisonment of up to five years, and prosecution costs.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Recycling – Changing the water heater”: the possibility of paying the financing to the institution once or partially

Libya: US General Meets Haftar Amid Tensions Between Governments

New tax exemption package and incentives for business and corporate mergers..